Credit scores are critical in personal finance as they are essential in determining eligibility for loans, credit cards, and other financial products. A credit score is a three-digit rating that represents a person’s creditworthiness. This blog post aims to provide an in-depth look at credit scoring, focusing on a 680 credit score. We’ll explore a credit score, its calculation, and the pros and cons of having a 680 credit score. We’ll also give you tips on improving a 680 credit score and the importance of getting a good score.

What is a credit score?

A credit score is an evaluation of a person’s creditworthiness. Higher scores represent higher creditworthiness. Credit scores are calculated from various factors, including payment history, credit usage, credit history, etc. There are many credit scoring systems, but the most commonly used is the FICO score.

Fair Isaac Corporation developed the FICO credit score. Most lenders use it to determine an individual’s creditworthiness. FICO scores range from 300 to 850, with higher scores representing better creditworthiness.

Read – How To Get An 850 Credit Score?

How are credit scores calculated?

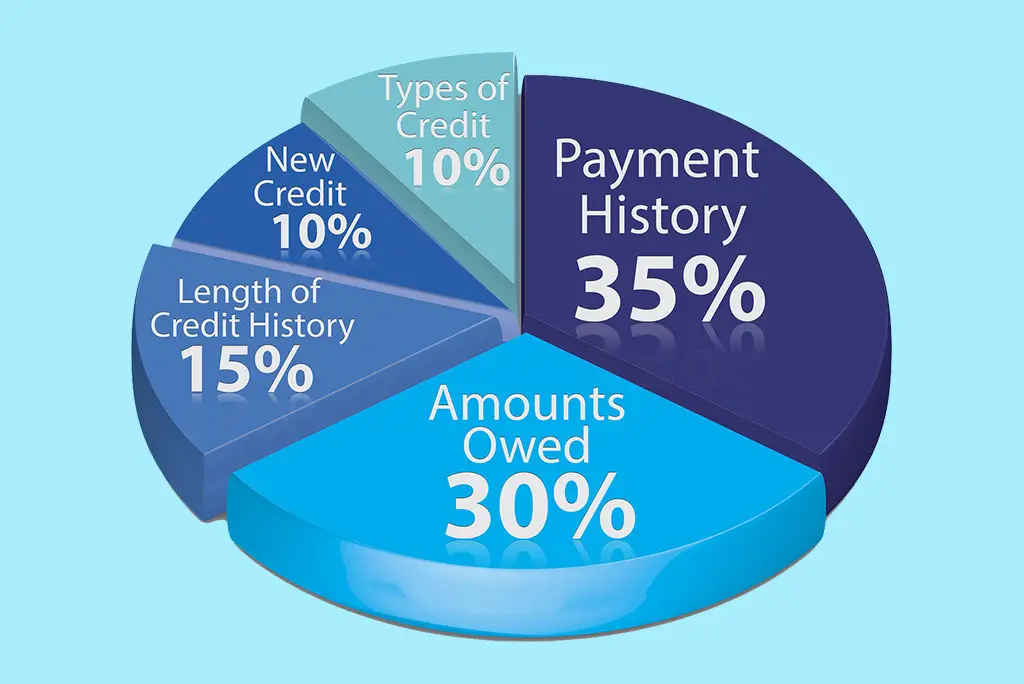

The FICO score calculation is based on five factors:

- Payment history

- Amounts owed

- Length of credit history

- New credit

- Types of credit used

Payment history is the most important, accounting for 35% of your credit score. Amounts owed account for 30% and length of credit history for 15%. The new credit accounts and types of credit used make for 10% each.

You can focus on paying your bills on time, reducing your credit card debt, and avoiding opening new credit cards to improve your credit score.

A good credit score is essential because it determines eligibility for loans, credit cards, and other financial products.

Read – Can You Pay Student Loans With a Credit Card?

Is 680 a good credit score?

According to the FICO scoring model, a 680 credit score is good as it falls between 670 and 739. It indicates that the person has a good credit history and is likely to be approved for a loan by most lenders. A credit score of 680 is not the highest, but it is still considered a good score and can help you get good loans and credit cards.

Pros and Cons of 680 Credit Score

-

Pros

- Access to Credit: Credit score 680 indicates that a person has a good credit history and will likely be approved. Lenders can help you get good credit and credit card rates.

- Better credit terms: With a credit score of 680, people can negotiate better credit terms, such as lower interest rates and better repayment terms, because they are considered fewer borrowers.

- Lower insurance rates: Insurance companies consider credit scores when determining insurance rates. Someone with a credit score of 680 may have lower insurance coverage than someone with a lower score.

-

Cons

- Credit Options: Individuals with a 680 score may have limited credit options because some lenders prefer people with higher credit scores.

- Higher interest rates: Although people with a credit score of 680 may still qualify for a loan, they will have to pay a higher interest rate than people with a higher score. This can increase the overall cost and make it harder to repay the loan.

- Difficulty approving high credit items: People with a credit score of 680 will have difficulties agreeing on high credit items such as a sound credit card or an outstanding loan.

These products often require higher credit scores and stricter credit requirements.

Read also – Top Credit Cards with $1,000 Limit with Guaranteed Approval

Comparison with other credit scores

Many people ask: Is a 680 credit score good? Based on the FICO score model, a 680 credit score lies in the excellent credit score range, i.e., 670 to 739. This indicates that the person has a good credit history. However, a higher score can increase the chances of getting better credit terms.

A credit score between 740 and 799 is considered excellent, and people with that score get better credit scores and lower interest rates. A score of 800 and above is regarded as the best, leading to better results.

Read also – How To Get An 850 Credit Score?

How to Increase Your 680 Credit Score

Raising your 680 credit score requires strategy and consistent effort. The given below steps can make to improve your credit score:

- Pay your bills on time: Payment history is the most critical factor for your credit score. Paying off your debts on time is crucial to improving your credit score.

- Lowering credit card balances: To improve your credit score, lowering your credit card balance and keeping your credit usage low is recommended.

- Don’t open new credit accounts frequently: Opening new credit accounts regularly will cause your credit score to drop. You should only open new loans occasionally to improve your credit score.

- Check the credit report regularly: You should check it regularly to find errors and take steps to correct them.

Read – Average Credit Card Debt Statistics in 2023

Do’s of Credit Management

Some credit management do’s and don’ts must be followed to achieve a good credit score. Here are some do’s and don’ts for credit management:

1. Pay your bills on time

One of the most essential habits everyone should do is to pay your bills on time. Whether you have rent, utilities, credit card, or other accounts, paying them on time will help you avoid late fees and penalties that can increase rapidly over time. It also enables you to maintain a good credit score, essential for long-term financial health. Late payments can negatively affect your credit score and make getting a loan or mortgage harder. That’s why it’s necessary to make sure you pay your bills on time, every time.

2. The cost of using a loan is still low

A loan can be an excellent financial tool if you manage it correctly. Used responsibly, credit can help you build a strong credit history and improve your credit score. In addition, if you pay your balance in full and on time, you can benefit from reward programs and avoid paying interest.

Read – 6 Best Credit Cards for Young Adults in 2023

Don’ts of Credit management

1. Late or Partial Payments

Failure to pay your bills on time or neglect to pay may adversely affect your credit score, resulting in late payments, penalties, and collections from creditors. This can make it harder for you to get a loan in the future or cause higher interest rates when you get a loan. Additionally, any outstanding or overdue payments will remain on your credit report for up to seven years, affecting your ability to obtain a loan and the terms and conditions of the loan.

2. Credit cards are running out

Credit cards can be a handy tool for managing your finances, but it’s important to remember that they’re not a lack of money. Keeping or maxing out your credit cards can lead to high-interest rates and make it harder to pay off your debt.

Additionally, relying on credit cards all the time can negatively affect your credit score, making it harder for you to get credit in the future.

3. There are usually many banks that offer loans

When looking for a loan, it’s essential to research and compare offers from different lenders. Different banks will have additional terms, fees, and charges, so finding the best deal for you is essential. It’s important to remember that borrowing too much from different lenders can negatively impact your credit score and make it harder for you to get a loan in the future. That’s why it’s essential to get good credit and only use debts you can easily manage.

Read – 5 Best Credit Cards After Bankruptcy

4. Ignore Credit Report

Your credit report contains important information about your credit history, including your payment history, outstanding debts, and loan application form. Reviewing your credit report regularly is essential to ensure the information is accurate and current. You should contact the credit bureau immediately if you find a mistake or error. Ignoring credit report errors can lead to lower credit scores and make it more challenging to get credit in the future. That’s why staying on top of your credit report and fixing errors as soon as possible is essential.

Tips for Maintaining a Good Credit Score

There are a few tips to follow to have a good credit score. Some tips for getting a good credit score:

- Pay your bills on time.

- Keep credit card balances low.

- Do not open new credits frequently.

- Check your credit report regularly.

- Make a good mix of credit types.

Conclusion

A credit score plays a vital role in personal finance, and a credit score of 680 is considered a good score. This blog post aims to provide an in-depth look at credit scoring, focusing on 680 credit scores.

We explore what a credit score is, how it’s calculated, and the pros and cons of having a 680 credit score. We also have tips on improving your 680 scores and the importance of getting a good score. Individuals can earn better credit scores by following credit management dos and don’ts and tips for good credit management.

Read also – 750 Credit Score: Is it Good or Bad?

FAQs

Q. Can I qualify for a mortgage with a 680 credit score?

A. Yes, you can qualify for a mortgage with a 680 credit score, but your interest rates may be higher. You may also need to provide a larger down payment.

Q. Can I get approved for a car loan with a 680 credit score?

A. Yes, you can get approved for a car loan with a 680 credit score, but your interest rates may be higher. You may also need to provide a larger down payment.

Q. How long does it take to improve a 680 credit score?

A. The time it takes to improve your 680 credit score depends on many factors, including your credit history and the work you’ve done to improve your credit. It can take months or years to improve your credit score.

Q. What kind of credit cards can I qualify for with a 680 credit score?

A. With 680 points, you can qualify for many credit cards, especially reward and balance transfer credit cards. However, a 680 credit score credit card may have a lower limit and benefits than those offered to applicants with higher credit scores.

Q. Can I qualify for a personal loan with a 680 credit score?

A. Yes, you can get a consumer loan with a credit score of 680, but the higher your credit score, the higher your interest rate will be. You may also need to provide additional information to show your creditworthiness.