Activating your Scotia credit card ensures secure transactions and unlocks its full potential. Activate the Scotia credit card to gain access to a powerful financial tool that allows you to make purchases, build credit, and enjoy various benefits. Let’s explore how to activate Scotia credit card and navigate any activation issues for a seamless and secure banking experience.

About Scotiabank

Scotiabank is a leading Canadian multinational bank founded in 1832. It offers various financial services, including banking, investment, insurance, and credit cards. With a presence in multiple countries, Scotiabank serves millions of customers, focusing on innovation and community initiatives.

Importance of Scotiabank credit card for secure transactions

- Activate Scotia credit cards to ensure secure transactions and protect your financial information.

- Activation confirms that you have received the card and allows you to set up a Personal Identification Number (PIN) or a One-Time Password (OTP), adding an extra layer of protection.

- Scotia credit card secures your transactions and protects against potential fraud or unauthorized use, allowing safe online banking, in-store purchases, etc.

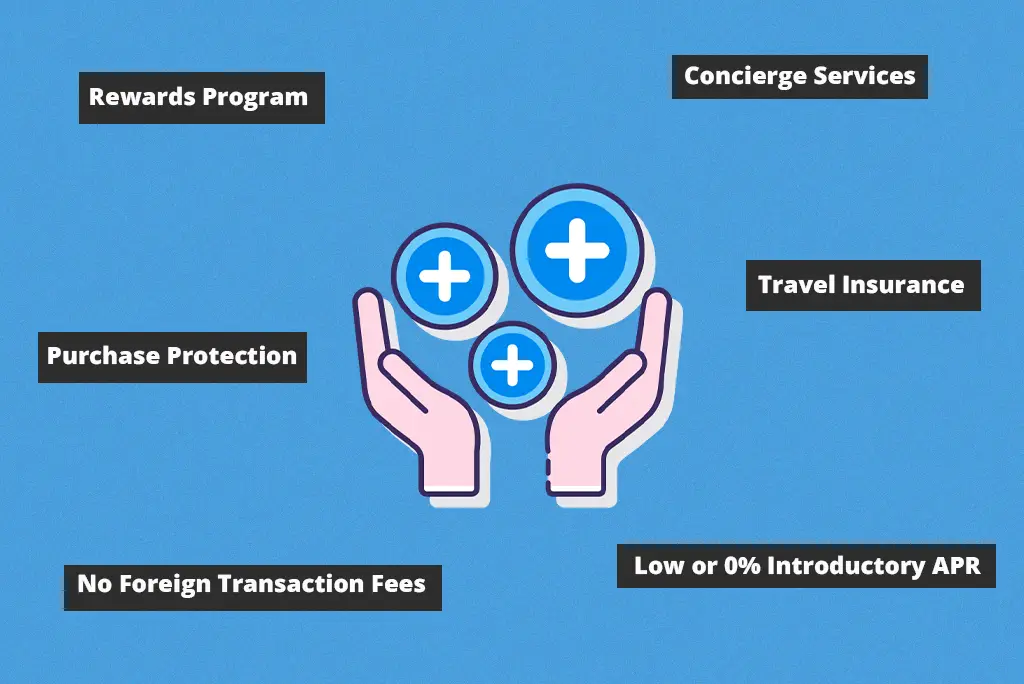

Benefits of Scotia credit cards

Activate Scotia credit cards to get specific benefits depending on the card type and your creditworthiness. Here are some expected benefits that Scotia credit cards may offer:

- Rewards Program: Scotia credit cards often come with rewards. Earn 4% for every $1 you spend on grocery store purchases, recurring bill payments, and subscription purchases. Earn 2% for every $1 you spend on gas and daily transit purchases. Earn 1% cash back on all other purchases with no cashback limit.

- Travel Insurance: Make sure to activate Scotia credit card to get travel insurance benefits, including travel medical insurance, trip cancellation/interruption insurance, and rental car insurance, providing peace of mind during your trips.

- Purchase Protection: Cardholders enjoy purchase protection, which offers coverage against damage or theft of eligible purchases made with the credit card for a limited period after the purchase date.

- Concierge Services: The Scotia credit card provides access to concierge services, assisting cardholders with travel arrangements, dining reservations, event tickets, and more, making it an ideal credit card for couples.

How to Activate Scotia Credit Card

1. Activate Scotia credit card online

- Visit Scotia Bank Website: Visit the official Scotia Bank website using a web browser on your computer or mobile device.

- Login or Create an Account: If you are an existing Scotia Bank customer, log in to your online banking account using your username and password. If you still need an account, you must create one by providing your personal and account information.

- Navigate to Credit Card Activation Page: Navigate to the credit card activation page once logged in. This can be found under your online banking dashboard’s “Credit Cards” or “Account Services” section.

- Enter Required Information: On the credit card activation page, you’ll be prompted to enter essential details related to your credit card. This may include your credit card number, expiration date, security code, and other relevant information.

- Confirm Activation: After entering the required information, please review it carefully to ensure it’s correct. Once verified, click the “Activate” or “Confirm” button to activate Scotia credit card.

- Activation Confirmation: Once you successfully activate your Scotia credit card, you will receive a confirmation message or notification indicating that your Scotia credit card is now active and ready to use.

2. Activate Scotia credit card via the mobile app

- Download Scotia Bank Mobile App: Start by downloading the official Scotia Bank mobile app from the App Store (for iOS devices) or Google Play Store (for Android devices). Install the app on your smartphone or tablet.

- Log In or Create an Account: If you are an existing Scotia Bank customer, launch the app and log in using your online banking credentials (username and password). If you don’t have an account, you must create one by providing your personal and account information.

- Go to Credit Card Activation Section: Navigate to the credit card activation section within the mobile app. This option would be under the “Credit Cards” or “Account Services” menu.

- Provide Necessary Details: To activate Scotia’s credit card, you will be prompted to enter essential details related to your credit card. This typically includes your credit card number, expiration date, security code, and other relevant information.

- Verify Activation: After entering the required information, carefully review it for accuracy. Once verified, tap the “Activate” or “Confirm” button to initiate activation.

- Activation Confirmation: After completing the steps to activate Scotia credit card, you will receive a confirmation message or notification within the mobile app indicating that your Scotia credit card is active and ready to use.

3. Activate Scotia credit card via phone

- Call Scotia Bank’s Customer Service: Start by calling Scotia Bank’s customer service phone number, which is usually provided on the back of your credit card or the bank’s website.

- Follow Automated Instructions: When you call, you will be greeted by an automated system. Follow the instructions provided by the system to navigate to the section to activate your Scotia credit card.

- Provide Required Card Details and Personal Information: Once you reach the credit card activation section, you’ll be prompted to enter the essential details of your credit card.

- Activation Confirmation: Upon successful activation, the automated system or the customer service representative will confirm that your card is active and ready for use.

Common Activation Issues

While the process to activate Scotia credit cards is generally straightforward, some common activation issues that cardholders may encounter include:

- Incorrect Information: Accidentally entering incorrect card details, such as the credit card number, expiration date, or security code, can lead to activation failure.

- Incomplete Documentation: Missing or incomplete information can cause delays or unsuccessful attempts.

- Technical Glitches: Occasionally, technical issues on the website or mobile app may hinder activation.

- Restricted Phone Access: In cases where cardholders call for phone activation, issues with phone network connectivity or restricted access to phone services can be obstacles.

- New Card Delays: Activation may fail if the card has not been physically received or is delayed in transit.

- Expired or Inactive Cards: Attempt to activate an inactive or expired Scotia credit card will not be successful.

- Security Locks: Some credit card issuers implement security measures, and if they detect unusual activity, the card might be temporarily locked for activation.

- International Activation: Cardholders may need to inform the bank to prevent foreign transaction issues while international travel.

Note – If you encounter any of these issues during the activation process, it’s best to contact Scotia Bank’s customer service.

Steps You Can Take to Resolve the Activation Issues

- Double-Check Information: Verify that you have entered all the required card details accurately, including the credit card number, expiration date, and security code.

- Try Alternate Activation Method: If one of the methods to activate your Scotia credit card isn’t working, consider activating via the abovementioned alternative methods.

- Contact Customer Service: Contact Scotia Bank’s customer service for assistance. They can provide guidance and troubleshoot the issue you’re facing.

- Confirm Card Status: Ensure your credit card is active and not expired.

- Clear Cache and Cookies: If you are activating through a web browser, clearing your browser’s cache and cookies might help resolve any technical glitches.

- Wait and Retry: Sometimes, activation issues can be temporary due to system maintenance or server load. Try to activate Scotia credit card later.

- Security Checks: If there are security concerns, verify your identity with the bank to ensure your card activation is secure.

- Visit a Branch: If all else fails, consider visiting a Scotia Bank branch. A bank representative can help you with how to activate Scotia credit cards.

Conclusion

Activate your Scotia credit card today to enjoy secure and hassle-free transactions. You add an extra layer of protection against unauthorized use and fraud by activating your card. Whether you’re shopping online or in-store, having an active card ensures peace of mind and confidence in your financial transactions. Don’t delay – activate your Scotia credit card now and unlock the full potential of your Scotia credit card!

FAQs

Q. What is the limit on a Scotia credit card?

A. Scotiabank’s eligible credit cards do not need a credit history and offer a credit limit of up to $5,000.

Q. What is the minimum income for a Scotiabank credit card?

A. Scotiabank assesses the minimum personal income as the primary factor. An American Express card requires an annual income of $12,000, while a Visa Infinite card requires a yearly income of $60,000.

Q. Can I use my Scotia card outside Canada?

A. The Scotia Card has Visa Debit functionality, enabling you to make online and global purchases directly from your bank account. This feature allows you to shop at numerous online stores and make in-store payments in the US and international shops without needing a credit card.

Q. How to activate a Scotiabank credit card?

A. To activate your Scotiabank credit card, you have three options. You can visit the online activation page, use the Scotiabank mobile app, or call 1-800-806-8600 for a swift, easy, and secure activation. After activation, your card will be ready for use.

Q. How to cancel a Scotiabank credit card?

A. The only way to cancel a Scotiabank credit card is via phone. You’ll need to call their customer service representatives at 1-866-267-4935.