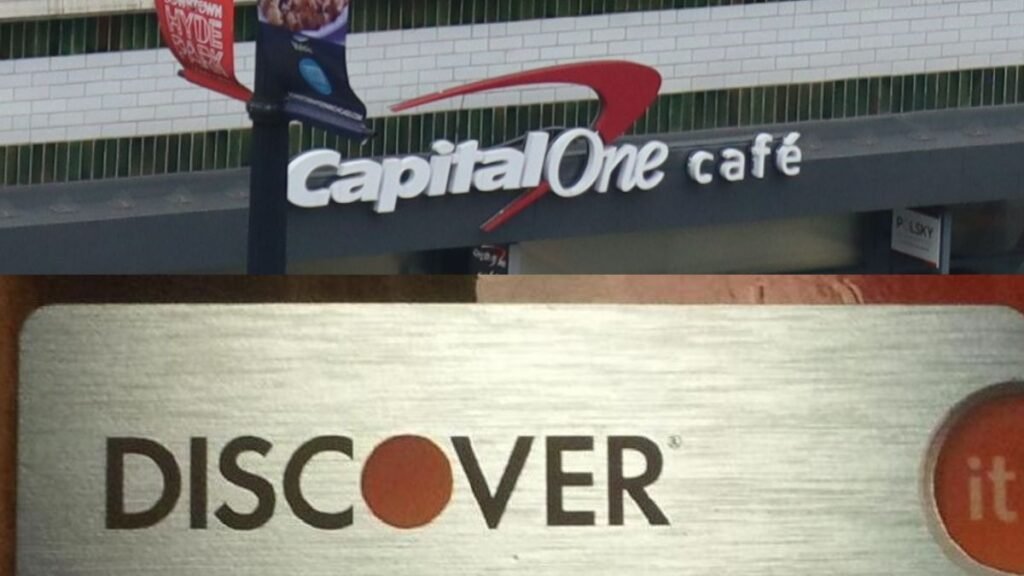

Capital One announced it would acquire Discover Financial Services, combining the two largest credit card companies in the United States. However, it is important to consider how this merger could affect credit card users.

What You Need to Know About this Merger

Capital One’s Discover Acquisition can result in the formation of the top credit card issuer in the U.S., even beating JP Morgan Chase and Citigroup. It has been reported that Capital will be based in Virginia but will also have a strong presence in Chicago, where Discover is headquartered. Capital hopes to reach more stores and make more money in the long run through this acquisition.

Capital One will still work with Visa and Mastercard but plans to move some of its cards to Discover’s network. With its payment network, Capital One aims to compete with American Express while relying less on Visa and Mastercard.

Capital is the ninth-largest bank in the US, with physician and online branches, whereas Discover mainly operates online for banking services. Through Capital One’s Discover Acquisition, both companies will focus more on their credit card offerings while expanding their networks.

After the acquisition, it has been reported that Disocver will keep its name and branding while continuing to be marketed as a separate brand by Capital One. The practical reason behind this decision was that converting Discover to the Capital One brand would require changes to the many stickers and online checkout pages, which already feature the company’s name and logo.

Richard Fairbank, CEO and Chairman of Capital One has said that they plan to shift some of their credit card businesses to Discover’s network, which will help increase their sales and reach more customers. The merger could also result in higher interest rates as larger credit card companies tend to have higher rates. According to the Federal Reserve, the average interest rate for cards with balances was about 22.75% in the last quarter of 2023.

According to a study by the Consumer Financial Protection Bureau (CFPB) in 2023, larger credit card issuers charge very high interest rates, with almost half of them having maximum rates over 30%. The study also showed that the interest rates differed vastly based on different credit scores. For those with good credit scores (620 to 719). The median interest rate from larger companies was 28.2%, much higher than what smaller issuers offer.

Moreover, big credit card companies have annual fees, which tend to be 70% higher than those at smaller banks and credit unions. However, big credit card companies offer more rewards and benefits, such as cashback or travel points.

Response to Capital One’s Discover Acquisition

Senator Elizabeth Warren, who has always advocated for tighter financial regulation, called on the federal officers to block the deal. Warren, also the chair of the Senate Banking Subcommittee on Economic Policy, recently tweeted on Twitter (now X) that the merger of the two companies threatens financial stability while reducing competition, which might result in high fees and credit costs for American families.

Adam Rust, director of financial services at the Consumer Federation of America, has said that people should worry about the credit card market, especially after this merger has been finalized. Issac Boltansky, director of policy research at BTIG, said that the merger would face high resistance from Washington as they might get anxious about consumers facing issues during the election year.

However, the decision to block this merger could be seen as helping Visa and MasterCard, the credit card giants. Between late 2022 and the end of 2023, Visa and MasterCard grew their revenues by 11% and 12.5%, respectively. According to the Nilson Report, the four companies- Visa, Mastercard, American Express, and Discover- reported $10 trillion in purchases in 2023, which is 6.4% higher than last year.

Matt Schulz, chief credit analyst at LendingTree, said that consumers would always prefer more competition as it implies options would be available to shop around. He adds that if Capital One and Discover have overlaps on what they bring to the table and want to combine each other instead of being two separate brands, consumers might end up with some of those offers getting reduced.

Read Also:

Global Central Banks Synchronization Era is Coming to an End