The Neo Credit Card is a financial product known for its cashback rewards feature. It allows cardholders to earn cash back on their everyday purchases. This card is popular among consumers who seek a simple and convenient way to save money while spending. It typically involves a percentage-based system, where a portion of the transaction amount is credited to the cardholder’s account. Its unique cashback earning feature has become an attractive option for various spending needs.

Neo Credit Card’s Cashback Earning Mechanism

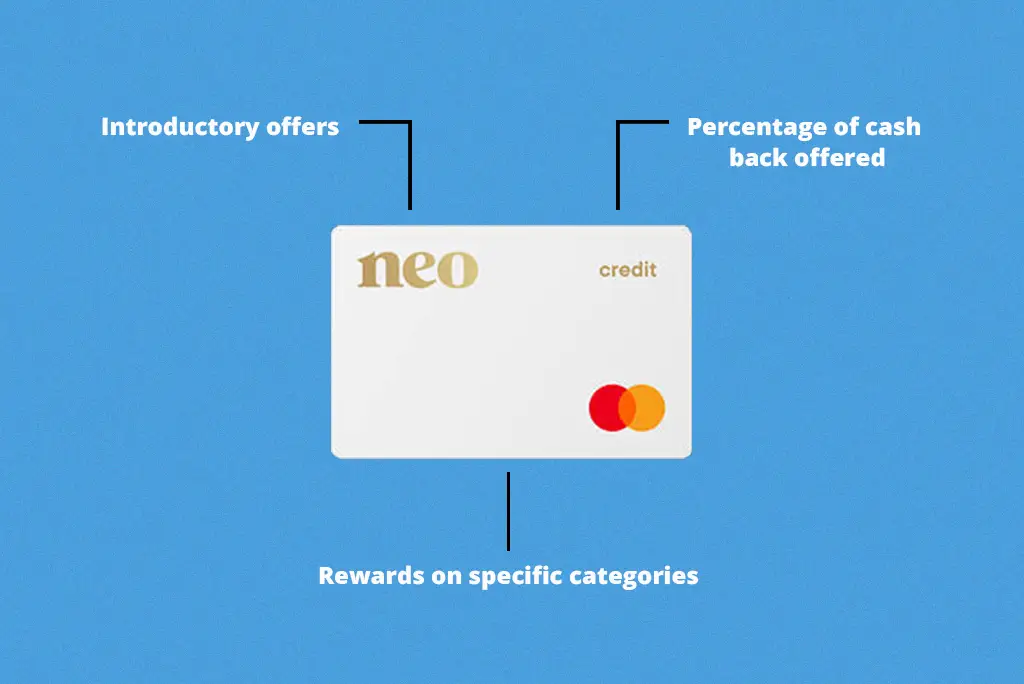

The unique cashback earning feature sets Neo Credit Card apart from other credit cards in the market. Unlike traditional rewards programs that may be complex or limited in redemption options, it offers a straightforward and convenient way to earn cash back on everyday purchases.

Users can easily track their cashback rewards with a percentage-based system, making it a transparent and rewarding experience.

It provides higher cashback rates for specific spending categories.

Moreover, the card often provides enticing introductory offers to attract new cardholders. These offer unlimited cashback rewards with no earning caps, sign-up bonuses, initial cashback boosts, or zero-interest periods on balance transfers and purchases.

These promotions aim to provide added value to users during the early stages of their card membership.

How does it work?

The cashback earning mechanism is straightforward and user-friendly. With each eligible transaction, a certain percentage of the purchase amount is credited back to the cardholder’s account as cash back. For example, if the card offers 2% cash back and a user makes a $100 purchase, they would receive $2 as cashback rewards.

Percentage of cashback offered

- Neo’s card options could be worth considering if you’re interested in cashback credit cards with no fees.

- Typically, credit card issuers provide varying cashback rates for different spending categories. Users can earn unlimited cashback rewards. Receive cashback rewards of up to 15% on first-time purchases with eligible partners.

- This feature encourages users to spend strategically to maximize their cashback rewards.

How to redeem cashback rewards

You can use your Neo cashback rewards in different ways:

- Put them in your Neo Money account to earn extra money over time.

- Use them to pay off your credit card balance.

- Spend them on things from Neo’s online store. You choose how you want to use them!

Applying for a Neo Credit Card

Eligibility criteria

- Applicants must be of legal age, typically 18 or older.

- Some credit cards require a minimum credit score of 680 to be considered. But not with Neo. Neo only requires a lower credit score of 600 to be approved for their credit cards.

- You must be a Canadian resident to be eligible for a Neo Financial credit card.

- To qualify for the Neo Secured Credit card, you must also provide a security funds deposit.

Application procedure

- Online application: To apply for one of Neo credit cards, you must create a Neo profile by entering your email address, phone number, and password.

- Personal information: The application requires personal details like name, contact information, and address.

- Financial information: Applicants must disclose their income, employment status, and other financial details.

- Credit history: The application typically includes consent to check the applicant’s credit history.

- Supporting documents: In some cases, additional documents like proof of income or identification may be required.

Approval process and time frame

- Review and verification: Once the application is submitted, the information provided is reviewed to verify the applicant’s eligibility.

- Credit check: A credit check assesses the applicant’s creditworthiness and history of managing credit.

- Approval decision: Based on the evaluation, the credit card issuer decides whether to approve or decline the application.

- Time frame: The approval process duration can take a few days to a couple of weeks to receive a response.

Fees and Other Charges

Annual fee

- You don’t need to pay a yearly fee. You can get all the benefits of a Neo Secured card without any annual charges.

Interest rates

- Purchase interest rates start at 19%.

- The Card carries purchase interest rates of 19.99% to 29.99% and cash advance rates of 22.99% to 31.99%.

- It is essential to check the card’s terms and conditions to understand the specific interest rates associated with different transactions.

Pros and Cons of Neo Credit Card

Advantages

- The primary advantage lies in its cashback rewards of up to 15% on first-time purchases.

- Cardholders can earn cashback on everyday purchases, providing an effortless way to save money while spending.

- Cardholders also enjoy shopping benefits, extended warranties, price protection, and special discounts from partner merchants.

Disadvantages

The Card has its disadvantages, like any financial product. Users must know its potential limitations and consider how it compares with other credit cards.

- Neo credit cards impose caps or limits on the amount of cashback you can earn within a specific time frame or on certain spending categories.

- Unlike most fee-free credit cards, you won’t get basic insurance such as purchase protection or an extended warranty with this Card.

- High-interest rates. Purchase interest rates reach as high as 29.99%.

Neo retail partners

Some of Neo’s cashback retail partners include:

- Ashley Homestore.

- Avis.

- Boston Pizza.

- Earls Kitchen + Bar.

- Frank And Oak.

- Harry Rosen.

- Saucony.

- Structube.

- Well.ca.

Who should consider a Neo credit card?

If you want a credit card without fees that give you cashback, you might like a Neo credit card. If you shop a lot at Neo partner stores, you can get even more benefits from their cashback program. The Neo Secured Credit card could be a good choice if you want to improve your credit score.

You should assess your spending habits and determine which credit card aligns best with your preferences and financial goals.

Final thoughts

The Neo Credit Card cashback rewards make it an appealing option for consumers seeking simplicity and tangible benefits. However, users should carefully review the card’s terms and conditions, including potential limitations and fees, to make an informed decision. Furthermore, comparing the Neo Credit Card with other credit cards can help users find the best fit for their spending habits and lifestyle.