Being a banker has never been a more exciting or potentially more difficult time. Fintechs that are disruptive, open banking, and high customer expectations are all making big changes in the banking industry.

Fintech firms are no longer just a couple of kids with a dream in a garage. Today, they are well-trained, have easy access to technology, and have a lot of money. They can now work on a large scale, and since Fintech is now a part of 35% of the financial services value chain, it is more important than ever to work with third-party providers.

In this new era, it’s important to find safe ways to break into closed systems so that anyone in the financial services value chain can use them to move money and information in real time. Working with Fintech, financial institutions can continue to play a crucial role in their customers’ experiences while improving their ability to keep customers and find new ways to make money.

What’s on the line?

Fintech and other third-party providers are making it harder for people to do business with banks. Businesses have quickly come up with new ideas and simple but powerful services that fill gaps in what traditional banks and credit unions offer. As deposits and payments with added value are spent down, bank accounts can become less profitable, and relationships with banks can get worse. Because it happens slowly, financial institutions may not realize what they’re losing until it’s too late.

Think about a card for Starbucks. When you recharge, the money goes straight from your bank to Starbucks. Starbucks now holds your money and makes buying things in-store like a bank is easy. Besides banks and credit unions, companies now offer various financial services, such as free stock trading, HSA accounts, investing, and many different ways to pay.

Finance Disrupted

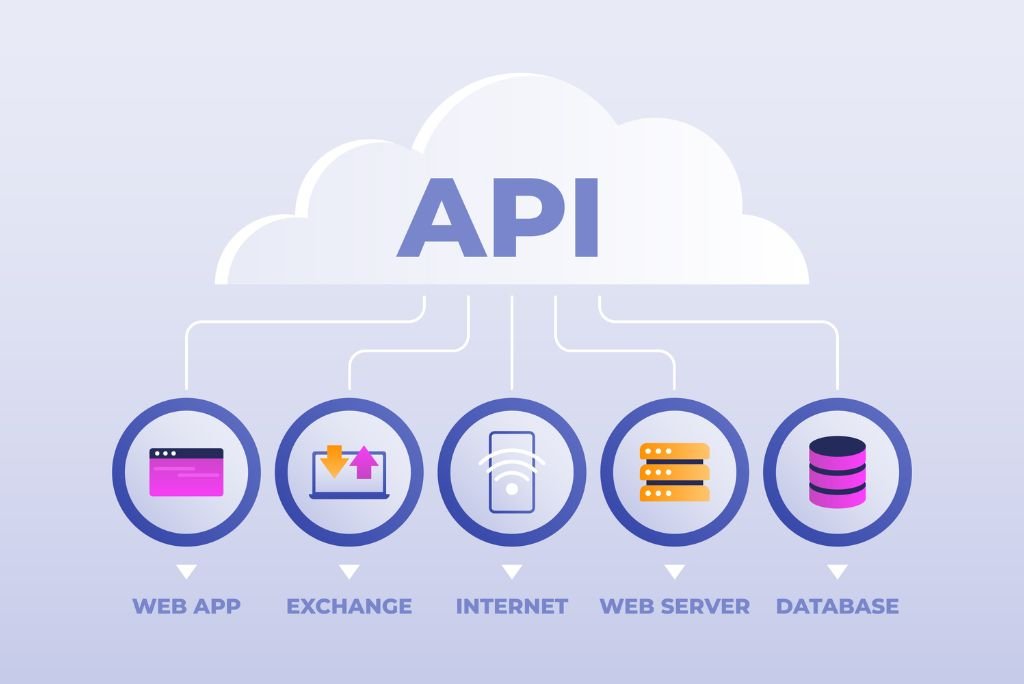

Cloud computing, Big Data, and APIs are examples of technologies enabling entrepreneurs to make new financial products that conveniently meet customer needs.

So, for existing financial institutions to stay competitive, they need to make innovation a part of their DNA by being as flexible as their digital counterparts. Agility can only be achieved by changing traditional business models and how an organization works. This requires integrating new technologies and fostering a culture of innovation so that these technologies can be used to their full potential.

Innovation

Some people are already ahead of the game. Financial companies like JPMorgan and Goldman have changed their business models by going digital in multiple ways. They used technologies like artificial intelligence (AI), robotic process automation (RPA), and big data.

For example, according to fintech financial news, JPMorgan will soon use its AI system, LOXM, to trade in its global equities algorithm business. This makes them up to two years ahead of their competitors. They started down this path of innovation many years ago with the help of superior management. This allowed them to try out several new ideas, which led to the development of LOXM.

But these innovations are more of an exception than the rule in finance. Most banks are just starting to change their systems to accommodate new ways of coming up with new ideas.

Ways to come up with new ideas

Large companies, like banks and insurance companies, realize that they need to develop new ideas. According to a report by PWC, CEOs care most about coming up with new ideas. There are many ways to develop new products for financial companies already in the market.

Some ways to develop new ideas work faster than others, like the venture capital model. With a VC approach, incumbents can invest in or buy a Fintech start-up outright to combine its products or services with their own.

For example, the French bank BNP Paribas bought the Fintech company Compete-Nickel earlier this year. The start-up shook up the French banking industry by making it easy and fast for customers to open a current account. Many incumbents find this service characteristic of Fintech start-ups hard to copy because of their old infrastructure and processes. As society becomes more digital, customers will want services that are easier to use. In 5 to 10 years, everything an incumbent does will be affected by digital, so they can’t avoid it.

In this situation, incumbents can’t keep using short-term strategies that only solve part of the problem. Instead, incumbents must develop strategic solutions that change how an organization thinks and acts.

How do you build a culture that encourages new ideas?

The first step is getting a team together to develop new ideas. The team’s job is to spread the idea of innovation throughout the organization. It works with many business areas to create relevant Fintech solutions that exploit opportunities and solve problems. This, in turn, can help bring innovation projects to the attention of the whole organization and set the stage for the next step.

If the team’s ideas are implemented with senior management’s support, they can lead to more results that can involve employees. In a sense, innovation teams are like spark plugs that help move product development forward. By combining their skilled resources and using an agile work method, incumbents can get their products to market faster by testing and proving new ideas quickly.

But there is one big catch. The work of innovation teams can only be constructive and long-lasting if everyone in the business agrees with it. So, putting together an innovation team is just the beginning.

Communication is the key to making cross-functional collaboration work, just like it is for most new strategic projects, especially when technology is involved. Employees need to understand why the new initiative is being started.

Creating trust and making success possible

The good news is that consumers still trust financial institutions, and they will continue to be an essential part of their lives. But customers want more and want it faster because that’s what they’re used to getting everywhere else in their lives. Because of this, some people may think that banks and credit unions aren’t as flexible in meeting their needs as a Fintech.

To change this perception and meet the growing demand for real-time, immediate, and always-on experiences, financial institutions will need flexible solutions that give consumers and businesses what they want. In the end, technology has always helped financial institutions do well.

Banks need to change how they think about Fintechs and use their power and flexibility to quickly bring new features to the market. This will give their organization and customers better information and solidify their place in the banking relationship’s center.

In this new banking era, banks need a digital mindset and an openness strategy that revolves around three themes: cloud enablement, an API-driven environment, and real-time access to data.

The Good Things About Banks in the Cloud

Cloud computing is becoming an essential part of giving customers better services. Even though the idea is simple, the scale, compliance, and high stakes of financial services for the cloud make them more challenging to understand. Financial institutions can choose between the public cloud, which companies like Amazon and Microsoft run, or the private cloud, which companies like Fiserv run out of their own data centers, or a hybrid model that uses both.

More and more, it’s clear that being in the cloud has benefits, such as the chance to save money and work more efficiently. Costs usually decrease when you use the cloud because of its scalable environment, flexible architecture, and pay-for-what-you-use pricing model.

Leaders of financial institutions sometimes say that security is a concern, but cloud deployment has a lot of potential to improve security. Companies offering public or private cloud computing can invest more money into security, risk management, and compliance than individual financial institutions. This means that environments on this scale are safe from risk and very resilient. And if you need extra services for risk and compliance, real-time fraud, and other security integrations, a cloud environment is usually more flexible.

The cloud is also great because it gives you this kind of flexibility. A core-hosted environment has protocols and standards, but changes are easy to make. Because the skills that Fintechs add aren’t unique to just one company, financial institutions can use their size to their advantage.

Open APIs have a lot of different uses

Open application programming interfaces (APIs) are fairly new and have many uses. An API environment creates an open market for co-innovation by giving Fintechs and other partners access to the data they need to make better experiences and more based on insights. That, in turn, lets financial institutions roll out new products and services quickly and at low cost. It also gives them new ways to make money.

When financial institutions open their APIs, they can charge third parties fees based on many factors, such as the amount or type of data they use. This is in addition to improving their current revenue streams. Through an app marketplace, financial organizations can build and sell new things to other organizations.

An open banking sandbox creates a dynamic testing, support, and validation environment that lets developers simulate the production environment without the usual risks. For example, a Fintech or other organization could use an API library and its data to create a solution for real-time micro-business lending and make it available to financial institutions and small-business owners.

Many banks and credit unions use strong API environments to offer new and different services. Fully grown APIs can handle multiple requests quickly and without problems, processing them at scale with the right controls and risk management measures. In the same way, people who use integrations from an app ecosystem want to plug in the app, test it, and then quickly and securely deploy it.

Can community banks jump on the bandwagon of open banking? I think that they should. A strong API environment lets financial institutions of all sizes quickly send innovative, pre-approved apps to customers. This improves customer satisfaction and helps them stand out from the competition.

As a hard alternative, organizations could write their customer interfaces for each application and do their documentation, risk assessment, testing, and deployment. That is a painful but necessary statement.

Real-time banking depends on having access to data in real-time

In a real-time setting, banking is a seven-day-a-week, 24-hour-a-day job. Real-time money movement is the first step in this fundamental change, but other features, like instant access to data, go along with it.

In the new real-time paradigm, a data warehouse, a centralized, enterprise-wide repository of information about customers, transactions, profitability, products, and channels, is of great value. This value is increased by business analytics tools that are easy to use and give financial institutions a full picture of the relationships between customers and households and historical trends.

Financial and transactional data can be used to make highly customized financial services and business insights that can be put to use. Instead of sending all the raw data from a day to a data warehouse to be analyzed overnight, financial institutions realize the value of getting those insights immediately.

It’s all about making decisions in real-time. For example, if a small business owner pays off a loan 36 months early and closes the account, a commercial banker wouldn’t find out about it until two or three days after the transaction has settled. By then, it’s too late to change what will happen. The owner of a small business and his or her money have already left the bank.

Real-time access to financial data is just as important for consumers who want up-to-date information on loan payments, account balances, transactions, and possible fraud. This speed also makes it possible to get financial insights that can help with budgeting and investing.

Conclusion

Banking is no longer a monopoly. Research suggests that individuals are more comfortable with technology businesses handling their money.

However, while customers trust the best fintech solutions, banks and credit unions remain a trusted, relationship-based location to perform financial transactions.

AI, open data standards, and machine learning will push community banks to innovate. Banks and credit unions that bring value and innovative ideas to their markets and communities will perform well.