Personal financial planning is a critical aspect of every individual’s life. A significant dilemma associated with it is that people consider themselves well-versed in personal financial planning without undertaking any specific research on personal finance and therefore end up spoiling their finances.

This article is a comprehensive guide on setting financial goals and tracking their success. Also, we’d like you to learn practical strategies for reaching your financial goals. This will help you seamlessly control your finances while attaining your financial goals.

Why setting personal financial goals is essential

Goal setting is a crucial aspect of personal finance. You might have hundreds of ideas on your finances floating around. However, any substantial change can be instituted only when you jot down your financial goal and craft various strategies in a specific direction. The benefits associated with goal setting include the following –

-

Guidance

When you set a personal finance goal, it becomes easier for you to undertake financial decisions in a particular manner. You can quickly comprehend when and where you need to make sacrifices to ensure your goals aren’t affected. In short, they provide a direction that helps you steer your financial decisions toward a specific purpose.

-

Responsibility

Setting up personal financial goals helps you keep track of your progress. The financial goals turn into a yardstick through which you can review your progress toward achieving the financial goals. The sense of responsibility ensures that you undertake various changes wherever necessary while pursuing your dreams.

How to set purposeful and achievable financial goals

The key to achieving success in personal finance lies in accurate goal setting. However, you should follow a step-by-step process to help you quickly achieve financial success. The process is as follows –

1. Work on the basics of your finance

Before proceeding on a journey of achieving your personal finance goals, it’s necessary to track the basics of your finance. Some of the key aspects are as follows –

- Emergency fund

An emergency fund is an adequate amount of money saved up beforehand for a rainy day. This money is supposed to come in handy in unexpected medical emergencies or an unexpected pink slip at work. An emergency fund usually consists of an amount that averages three to six months’ worth of expenses for an individual. The money is generally stored in a savings account, wherein it’s easily accessible.

- Clearing your debt

High-intensity debts such as credit card payments or high-interest loans for personal purposes severely dent your monthly paycheck. Therefore it’s necessary to clear off such debts because they act as a significant liability and can cause massive hindrances in achieving your financial goals.

- Planning for retirement

An individual should start preparing for retirement when he starts earning substantial money. Early planning helps you reap the magical benefits of compound interest. Therefore start saving up for retirement as soon as possible consistently.

2. List down your financial goals on a priority basis

Start by jotting down all your financial goals. List out each plan that traverses your mind. After the initial process of listing down each goal, start focusing on the specifics. The details you are supposed to look into are the amount of money needed for the plan, the timeline, and how much progress has already been made.

Could you start listing the goals based on priority and mark whether they are long-term or short-term? The stresses and definition of short or long-term depending on the plan. After analyzing, determine the goals that should be prioritized and those that can take a backseat.

3. Curate a financial plan

A financial plan is critical to help execute your financial planning. Start by listing your various income sources and determining their nature, whether they are cyclic, etc. After you get an idea about the cash flow in your hand, you should start focusing on combining these aspects and moving towards achieving your financial goals. To do this, consider consulting a finance professional or utilizing various personal finance tools to achieve your goals.

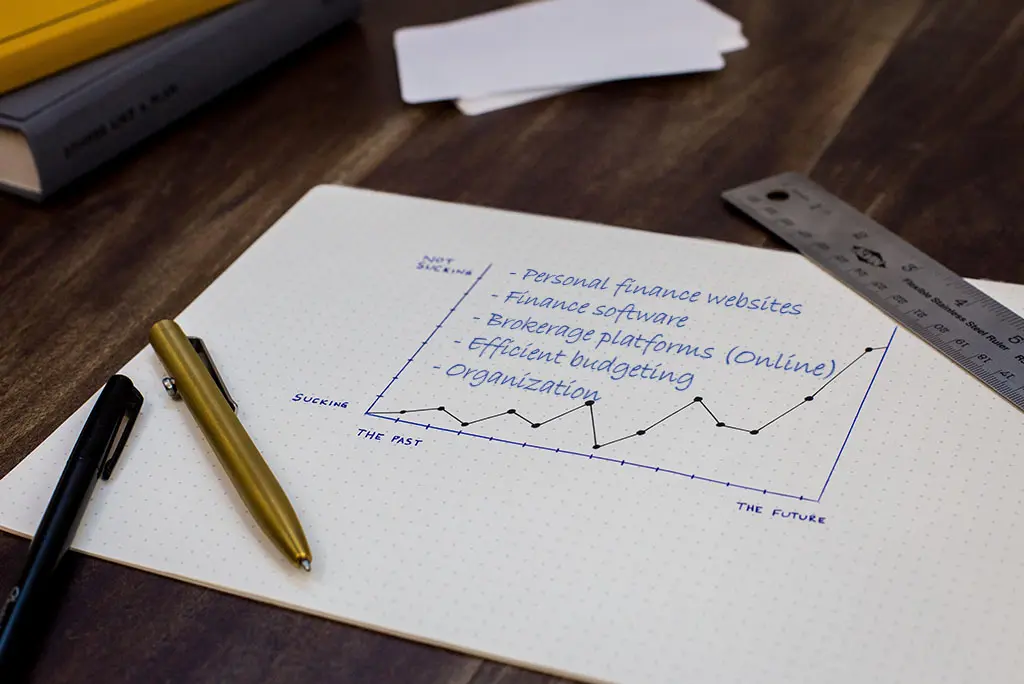

What are the personal financial planning tools and resources that can be used?

While pursuing your personal finance goals, you must utilize various tools and resources that help grow your financial goals exponentially. These are some of the types of tools and resources that will aid you in accomplishing your goals.

1. Personal finance websites

These websites provide resources and actionable tools focusing on managing your finances. Some websites, such as Mint.com or NerdWallet, provide various devices, such as investment calculators or tools focusing on budgeting which aid in crafting the perfect financial plan. Also, multiple resources on these websites will help you plan the ideal financial strategy.

2. Finance software

Various software such as Quicken or YNAB provides individuals with tools that focus on budgeting and tracking their financial goals and multiple applications which focus on managing your investments. They also provide individuals with tax preparation support.

3. Brokerage platforms (Online)

Various brokerage platforms which are online in nature, such as Fidelity, and Charles Schwab, help individuals with the perfect investment strategies by providing them with multiple research tools with a focus on portfolio analytics. These platforms will help you with insights on portfolio diversification and methods to manage your overall personal finance investments seamlessly.

These personal financial planning tools and resources should be used for financial planning. The benefits associated with these tools and resources are as follows –

-

Efficient budgeting

Budgeting Software helps you gain specific insights into your spending. It can help you pinpoint your shortcomings while managing your finances and help in initiating necessary changes.

-

Organization

Software and tools help you gain deeper insights into your finances. Organizing all your financial data into a centralized structure enables you to understand your overall inflows and outflows.

Benefits of working with a certified financial advisor

A financial advisor is a professional who aims to ensure your capital is invested explicitly into suitable financial vehicles. The financial planner ensures that you attain maximum profits out of your investments. The range of services provided by financial advisors differs from professional to professional. Here are some benefits of working with a certified financial advisor –

-

Customization

A significant advantage of working with a financial advisor is they can curate a customized financial plan according to an individual’s finances. The personalized plan helps you focus on your goals while minimizing the risk.

-

Future-ready

A Financial advisor can help an individual plan adequately for the future. They consider various features such as inflation, risks, and predictable market conditions. A study determined that individuals who had opted for a financial advisor showed lower signs of distress during the pandemic.

There are various financial advisors available in the financial industry. Therefore, you’ll need to make an adequate steps-based approach to find the perfect financial advisor. Here are the necessary steps to keep in mind before choosing a financial advisor –

- Determine your economic necessities.

- Research various certified financial advisors near you. Understand the types of services provided by them and determine whether your personal finance goals and their services match each other.

- Consider the advisor’s fees and determine whether it’s feasible for you.

- Conduct a background check of the financial advisor and verify their credentials and successes.

How to track your progress toward financial goals

While curating your financial plan, you should break it down into chunks. At the end of each piece, an individual should review his progress and list the shortcomings while analyzing the overall progress. This ensures that you achieve your financial goal step by step. Monitoring your progress periodically helps in keeping a check on your progress. A bare timeframe-based periodic checking should be done after three or six months. Apart from that, monitoring can be done based on the objective. The monitoring period should be about one month if it’s a short-term objective. In contrast, a long-term goal should be monitored quarterly or annually, depending on the time frame.

If you are working with a financial advisor, you must meet him periodically to check your portfolio’s progress.

Although the entire article lists the path of personal finance as a linear approach-based model wherein success is guaranteed after a stipulated period, there are chances that unexpected factors might come into the picture. There might be a sudden layoff or prolonged sickness, which might disrupt the cash flow. At such a moment, I would like you to step back and revisit your financial plans.

Financial planning is a moving process. Instead, it considers various unexpected events and moves further, focusing on the bigger picture. Without financial planning, you might lose hope during an unanticipated economic turmoil. However, when there’s a financial plan already in place beforehand, you have a centralized picture in your mind, and you know what you should do to get back on track.