Crate and Barrel is known as a home furnishing retailer. However, it has started offering credit cards with limited benefits. The Crate and Barrel Credit Card is similar to many other store cards and does not have features like a sign-up bonus.

The Crate and Barrel Credit Card can be used to shop at Crate and Barrel, Crate and Kids, and CB2 stores, websites, and catalogs in the United States. The Crate and Barrel Mastercard can be used worldwide, wherever the Mastercard is accepted.

Types of Crate and Barrel Credit Cards

There are two types of Crate and Barrel cards: the Crate and Barrel credit card and the Crate and Barrel Mastercard. The Crate and Barrel credit card can only be used at Crate and Barrel and affiliated stores, while the Crate and Barrel Mastercard can be used anywhere. Your creditworthiness determines which card you get.

The Crate and Barrel credit card and the Crate and Barrel Mastercard earn rewards for Crate and Barrel purchases, but the Crate and Barrel Mastercard offers additional rewards. This includes 2% cashback on grocery store purchases, not including warehouse clubs like Costco, and 1% back on other purchases.

Crate and Barrel Credit Card Features

Crate and Barrel Credit Card cardholders have two main perks to choose from, but they cannot be used together. The cardholders for the Crate and Barrel Credit Card and Crate and Barrel Mastercard can earn 10% back for every $200 spent at Crate and Barrel.

Crate and Barrel credit cardholders also have special financing for $749 or more purchases. If an order qualifies for 10% back and special financing, you must pick one option. You must refrain from receiving rewards on a purchase that is also being financed.

Benefits of Crate and Barrel Credit Card

Crate and Barrel Credit Card:

- Earn 10% back in Reward Dollars or receive 6 months of special financing on purchases of $749 or more at Crate and Barrel.

- No annual fee.

Crate and Barrel Mastercard:

- Enjoy all the benefits of the Crate and Barrel Credit Card.

- Additionally, access Mastercard member benefits.

- Moreover, Earn 2% back in Reward Dollars on grocery store purchases.

- Earn 1% back in Reward Dollars on every other purchase anywhere Mastercard is accepted.

Financing Options

The Crate and Barrel credit card offers three unique financing options:

1. 6 months of special financing on purchases of $749 or more. This offer has no expiration date.

2. 12 months of special financing on purchases of $1,499–$2,998.99 made before December 31, 2024.

3. 24 months of special financing on purchases of $2,999 or more before December 31, 2024.

Special financing may sound good, but it comes with risks. If you do not pay off the entire balance before the financing period ends, you will owe interest on the total purchase amount, starting from the purchase date. Unlike actual 0% intro APR cards, which only charge interest on remaining balances after the intro period ends, special financing can lead to retroactive interest charges.

For example, the Bank of America® Customized Cash Rewards credit card offers a 0% Intro APR for 15 billing cycles for purchases and balance transfers within the first 60 days. After the intro period, a Variable APR applies. Additionally, cardholders can earn 3% cash back on home improvement and furnishings purchases. They can earn up to $2,500 combined quarterly spending in that category and at grocery stores and wholesale clubs. However, users must select home improvement and furnishings as their 3% bonus category.

How to Apply for a Crate and Barrel Credit Card

- Visit a Crate and Barrel or CB2 store or website. To apply online, go to the rewards page on the Crate and Barrel website and click on the Apply Now button to apply for the Crate and Barrel card.

- Fill out the application form.

- If you’re approved instantly, you’ll receive a Temporary Account Number for 15 days to shop in-store or online.

- Your new credit card will be sent to you by mail within 7-10 business days.

- If you’re approved later, you’ll receive further information about your application status via mail or email within 10 days.

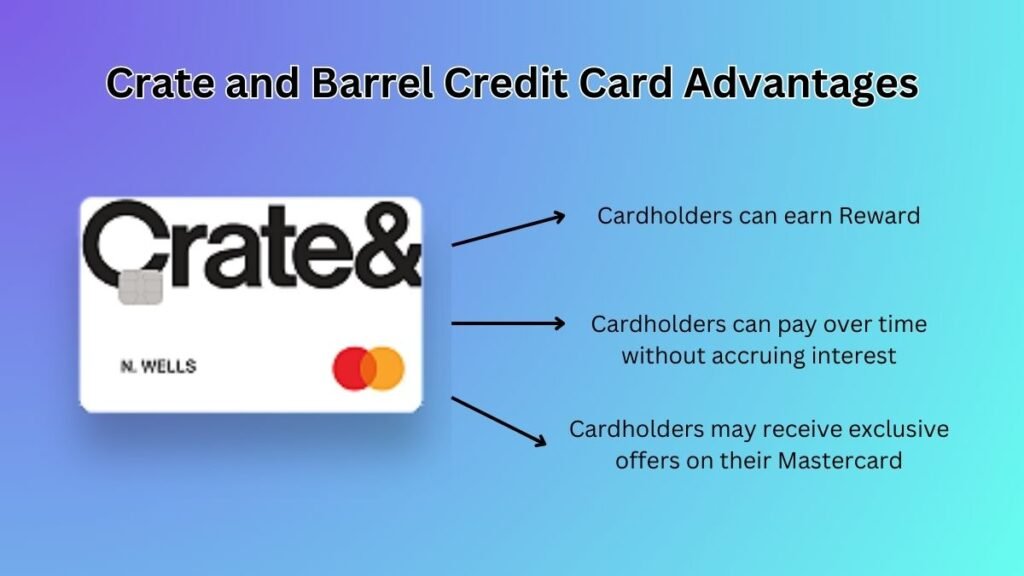

Crate and Barrel Credit Card Advantages

The Crate and Barrel credit card offers several benefits, including:

Cardholders can earn Reward Dollars on purchases made at Crate and Barrel and affiliated stores.

The card provides unique financing options for qualifying purchases, allowing cardholders to pay over time without accruing interest, depending on the purchase amount and financing term.

The Crate and Barrel Mastercard offers additional rewards, such as cashback on grocery store purchases and other purchases made outside Crate and Barrel stores.

Cardholders may receive exclusive offers and promotions tailored to cardholders.

The card provides a convenient payment method for purchases at Crate and Barrel and other retailers that accept MasterCard.

Disadvantages of Crate and Barrel Credit Card

The Crate and Barrel card offers high reward rates, but redeeming those rewards is limited. Your rewards are converted into Reward Certificates in $20 increments, which can only be used within Crate and Barrel’s brand umbrella.

Moreover, waiting until you reach the $20 minimum threshold to receive Reward Certificates would be best. Reward Certificates expire 90 days after issuance. They can not be combined with other store discounts, and any unused portion is forfeited. In contrast, many cashback credit cards allow more flexible redemption without minimum thresholds, expiration dates, or the risk of forfeiting value.

Moreover, the interest rate on both Crate and Barrel cards was 32.24% as of February 2024. According to the Federal Reserve, this is higher than the average interest rate for all credit cards, which was 22.63% in the same month.

Read Also:

Best Credit Card Bonuses for New Cardholders in April 2024

New Robinhood Credit Card Offers 3% Cash Back on Most Purchases