Comenity Bank issues the Eddie Bauer credit card. It comes with high-interest rates, benefits, and reward redemption options. However, most benefits can be obtained by simply joining Eddie Bauer’s loyalty program, which is a better option for brand fans than getting an Eddie Bauer credit card.

Eddie Bauer Loyalty Program

To understand the main benefit of the Eddie Bauer credit card, it is essential to first understand how Eddie Bauer’s free loyalty program works. The Eddie Bauer Adventure Rewards program consists of three levels: Adventurer, Explorer, and Guide.

Each level offers different benefits, including free shipping at varying purchase amounts. Members earn rewards on purchases made with their member number, excluding gift card purchases. Additional points can be earned by signing up for text message marketing and receiving a birthday discount offer.

Rewards are issued quarterly in $5 increments, with a maximum of $80 per redemption period. If no purchases are made, points expire after 12 months. Rewards can be used at Eddie Bauer stores, online, or on phone orders and cannot be exchanged for cash or combined with other offers.

Your level in the Eddie Bauer Adventure Rewards program depends on how much you’ve spent at Eddie Bauer in the last 12 months:

- If you’ve spent less than $300, you’re an Adventurer.

- If you’ve spent between $300 and $599.99, you’re an Explorer.

- If you’ve spent $600 or more, you’re a Guide.

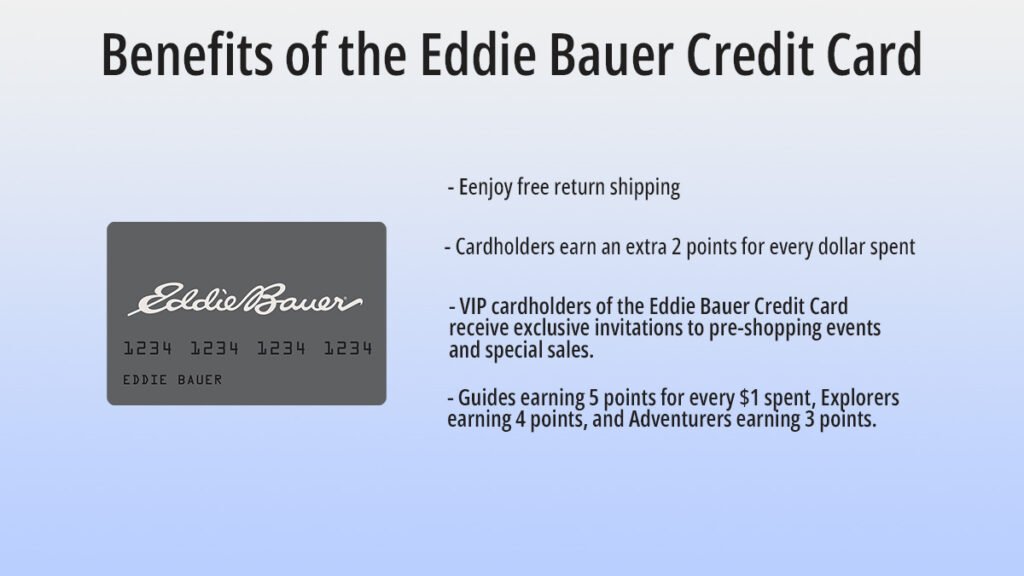

Benefits of the Eddie Bauer Credit Card

The Eddie Bauer Credit Cards offer several benefits to cardholders.

- Cardholders earn 2 points for every dollar an Eddie Bauer Adventure Rewards member spends.

- They also enjoy free return shipping on all orders made with their Eddie Bauer Credit Card.

- VIP cardholders of the Eddie Bauer Credit Card receive exclusive invitations to pre-shopping events and special sales, exclusively for cardholders.

- Additionally, an individual’s status within the rewards program depends on how much they spent at Eddie Bauer within the last 12 months. Guides earn 5 points for every $1 spent, Explorers earn 4 points, and Adventurers earn 3 points. Cardholders earn an extra 2 points for every $1 spent, regardless of loyalty status level. However, free return shipping as a perk is only available to those who have achieved Guide status.

How to Redeem Eddie Bauer Credit Card Rewards

Redeeming rewards with the Eddie Bauer credit card comes with a set of rules and regulations. Unlike some cards with rewards that never expire, the Eddie Bauer credit card comes with several rules:

- Points expire after 12 months without a purchase.

- Rewards are issued every quarter in $5 increments and have expiration dates.

- You can redeem rewards only for future Eddie Bauer purchases.

- Earned rewards are capped at $80 per redemption period.

- Each point is worth 1 cent, which is a good value, but navigating the redemption process requires attention to these details.

Fees of Eddie Bauer Credit Card

- Annual Fee: $0

- APR on Purchases: 32.24%

- Purchase Intro APR: Not Offered

- Transfer Intro APR: Not Offered

Eddie Bauer Credit Card Eligibility

To be eligible for an Eddie Bauer Credit Card,

- One must meet the legal age requirements in your state,

- Have a U.S. mailing address (excluding P.O. Box addresses),

- Present a valid government-issued photo I.D. if applying in-store. In-store and online applications require a valid government-issued Taxpayer Identification Number, such as an SSN or SIN.

- You can join the Adventure Rewards program by creating an online account on Eddie Bauer’s website or enrolling in stores.

- You do not need to purchase to join, but you will get more benefits based on your purchases.

- Membership is for individuals only and cannot be shared with others or used by corporations, groups, or associations.

Other Information

- Points are usually awarded within 72 hours of your purchase or qualifying activity. If you are still waiting to see your rewards or think there’s an error, you must notify customer service within two weeks.

- Rewards are non-transferable; no change is given for purchases less than the reward value.

- You do not need a physical card for membership, but you can access a digital card through your online account or by contacting customer service if required.

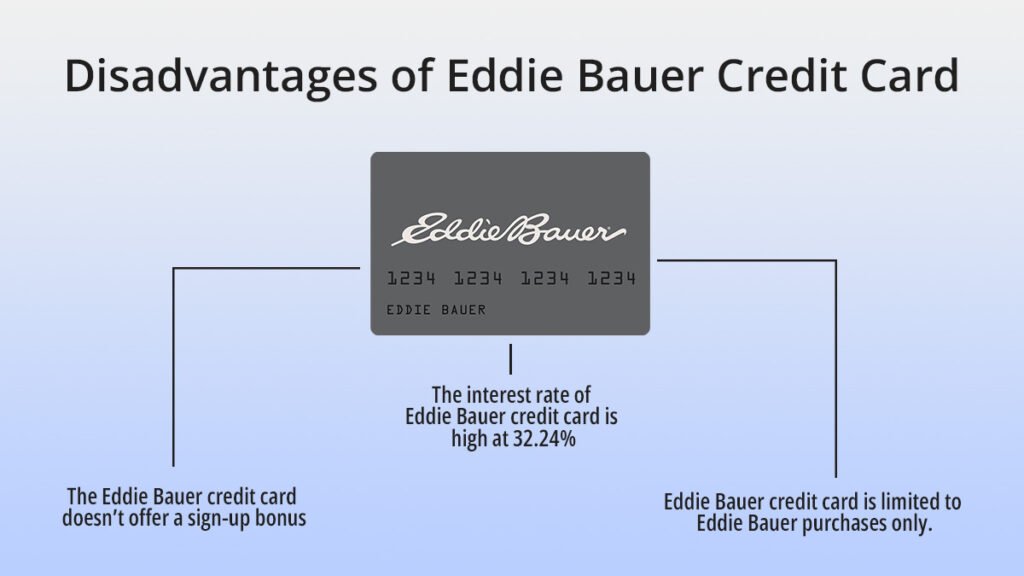

Disadvantages of Eddie Bauer Credit Card

- The Eddie Bauer credit card doesn’t offer a sign-up bonus, which is unusual for store cards.

- The Eddie Bauer credit card’s interest rate is 32.24%, making it costly to carry a balance.

- The Eddie Bauer credit card is also limited to only Eddie Bauer purchases.

FAQs

What happens after you apply for an Eddie Bauer Credit Card online?

When you apply online, you will get a quick response regarding the status of your application. This means you will know immediately whether you have been approved.

Where can you find information about the Eddie Bauer Credit Card fees?

Please review the Credit Card Agreement (CCA) for details about any fees or charges related to your Eddie Bauer Credit Card membership. This document covers essential account management information and can be reviewed online.

How do I access the Credit Card Agreement (CCA)?

The current Credit Card Agreement (CCA) is available online for review. It contains detailed explanations of the terms and conditions associated with the Eddie Bauer Credit Card.

Read Also:

Best Credit Card Bonuses for New Cardholders in April 2024

Chase’s 5% Bonus Categories for Q2 2024

Marriott Bonvoy Cards Offer Big Welcome Bonus, Get Up to 185000 Points