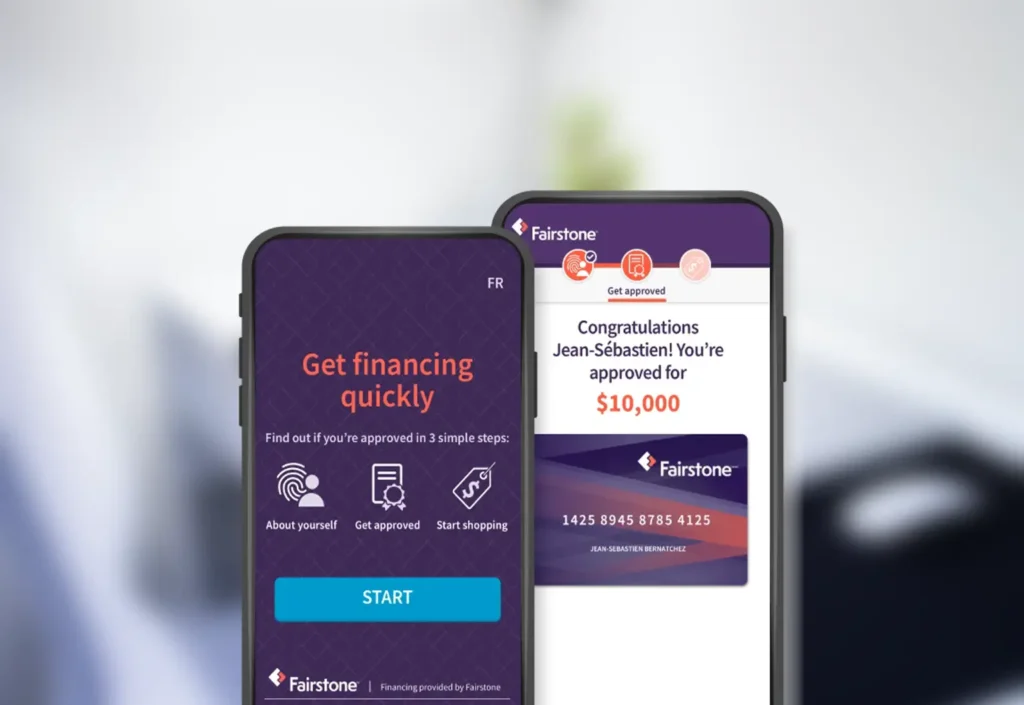

The Fairstone credit card may have a moderate credit limit and often does not require applicants to provide a security deposit. The Fairstone credit cards have a simple application process, allowing users to apply online through the Fairstone website or their online portal.

Let’s look at the features and pros & cons of the Fairstone credit card and compare it with other payment methods to check if it’s suitable for you.

Features of Fairstone Credit Card

Credit Limit and Eligibility Criteria

- The Fairstone credit card typically comes with a moderate credit limit, which may vary depending on the applicant’s creditworthiness and financial situation.

- The credit limit represents the maximum amount the cardholder can borrow on the card.

- Eligibility criteria for the Fairstone credit card may include factors such as the applicant’s age, income level, employment status, and credit history.

- Fairstone credit card aims to provide credit options for individuals with various credit backgrounds, including those with limited or no credit history.

Interest Rates and Fees

- The annual percentage rate (APR) determines the interest on outstanding balances.

- At Fairstone, unsecured personal loan amounts range from $5,000 to $50,000, with 6 to 60-month loan terms and interest starting at 26.99%.

- The secured personal loan amounts range from $5,000 to $50,000, with loan terms of 36 to 120 months, and interest starting at 19.99%

- Cardholders need to pay attention to the APR, as higher rates can lead to increased interest costs on balances carried from month to month.

Rewards and Benefits

- The Fairstone credit card primarily focuses on helping users build or rebuild their credit history to get a good credit score. Reward credit cards can be used like any other credit card, but they come with an extra incentive program to give something back to their users.

- The points systems can be used for flights, hotels, cruises, or other items from a catalog of rewards.

Pros of Using Fairstone Credit Card for Building Credit

- The application process is designed to be straightforward and user-friendly, allowing potential cardholders to apply easily through their website or online portal.

- Personal loan amounts up to $50,000.

- It provides unsecured and secured loan options.

- Fairstone credit card aims to provide accessible credit options to individuals with varying credit backgrounds, including those with limited credit history.

- Another advantage of the Fairstone credit card is the potential for regular credit limit increase opportunities. As cardholders demonstrate responsible credit usage, make on-time payments, and maintain a positive credit history, they are eligible for credit limit increases. This can be beneficial for building a more robust credit profile, as it increases the available credit and lowers the credit utilization ratio.

- The Fairstone credit card reports cardholders’ credit activity to major credit bureaus. Regular reporting to credit bureaus is a critical aspect of building credit.

Overall, the Fairstone credit card provides several benefits for individuals looking to build or rebuild their credit history. The simplified application process, the potential for credit limit increases, and reporting to credit bureaus contribute to a positive credit-building experience. Additionally, the availability of personalized credit management tools further supports users in achieving their credit goals.

Cons of Using a Fairstone Credit Card for Building Credit

- One of the cons of using the Fairstone credit card for building credit is the possibility of higher interest rates.

- The card may come with a higher Annual Percentage Rate (APR) than other credit cards, especially those offered to individuals with established credit histories.

- Higher interest rates can result in increased finance charges if cardholders carry a balance from month to month.

- To avoid paying excessive interest, users must pay off their balances in full and on time.

- Added home valuation, administration fees, and title examination for secured personal loans.

Comparison with Other Credit Building Options

1. Secured Credit Cards

- Secured credit cards are a standard option for individuals with limited or poor credit history who want to build or rebuild their credit.

- Unlike unsecured credit cards, secured cards require the cardholder to make a cash deposit as collateral, which typically becomes their credit limit.

- The deposit reduces the risk for the card issuer, making secured cards more accessible to individuals with lower credit scores.

- As the cardholder uses the secured credit card responsibly and makes on-time payments, their credit activity is reported to credit bureaus, helping establish or improve their credit history.

- With consistent positive credit behavior, cardholders may become eligible for unsecured credit cards and receive their deposit back.

2. Credit Builder Loans

- Credit builder loans are specifically designed to help individuals build credit.

- They work differently from traditional loans because the borrowed money is held in a savings account or certificate of deposit (CD) while the borrower makes regular payments.

- The lender reports these payments to credit bureaus, which helps establish a positive credit history.

- Once the credit builder loan is fully paid off, the borrower gains access to the funds previously held in the savings account or CD.

- These loans benefit those with limited or no credit history, providing a structured way to build credit without taking on significant debt.

3. Authorized User on Someone Else’s Card

- Becoming an authorized user on someone else’s credit card can be a credit-building option for individuals with limited credit history.

- When added as an authorized user, the cardholder’s credit activity on that card is reported to credit bureaus, potentially impacting their credit score.

- However, the impact of this arrangement depends on how responsibly the primary cardholder uses the credit card.

- If the primary cardholder has good credit habits and maintains a low credit utilization ratio, it can positively affect the authorized user’s credit.

- On the other hand, if the primary cardholder has negative credit behavior, it could harm the authorized user’s credit.

Comparison

- Risk and Collateral

Secured credit cards require a security deposit, which serves as collateral, while credit builder loans involve holding the borrowed funds as security. In contrast, becoming an authorized user doesn’t require any collateral.

- Debt vs. Savings

Secured credit cards involve borrowing against the security deposit, leading to potential credit card debt. Credit builder loans focus on building savings, and once fully paid, the borrower receives the savings back. Authorized users don’t assume any financial responsibility for the card’s charges.

- Credit Reporting

All three options report credit activity to credit bureaus, helping to establish or improve credit history. However, authorized users’ credit impact depends on the primary cardholder’s behavior.

Each credit-building option has its advantages and considerations. Individuals must assess their financial situation, goals, and comfort level before choosing the best approach for building or rebuilding their credit.

Conclusion

The Fairstone credit card can be suitable for individuals looking to build or rebuild their credit history. Its simplified application process and regular credit limit increase opportunities make it accessible to those with limited credit backgrounds. Additionally, reporting to credit bureaus and personalized Fairstone credit card management tools provide valuable resources to monitor and improve credit scores.

However, there are drawbacks, such as potentially higher interest rates and limited rewards compared to other credit cards. Additionally, users should be mindful of possible fees associated with certain transactions.

FAQs

What kind of bank is Fairstone?

Fairstone is an operating subsidiary of Fairstone Bank of Canada. It has been a trusted Canadian lender, providing services for about 100 years. It offers credit services, solutions for credit financing, protection services, and Guaranteed Investment Certificates (GICs).

What is the Fairstone interest rate?

Fairstone offers personal loans ranging from $500 to $50,000, with interest rates between 19.99% and 39.99%. Loan terms can be as short as 6 months or as long as 120 months. These loans are quite costly, and you should explore alternative loan options.

Can I use my Fairstone card anywhere?

You’re limited to using your financing account or store card, specifically with the retailer you enrolled with. This applies to all the retailer’s associated Canadian branches or locations that accept Fairstone financing.

How do I pay my Fairstone credit card online?

First, log into your online account and click the ‘Make a Payment’ button. You’ll have to decide between making a one-time payment or setting up recurring payments. Then, provide your banking details to finish the process.

Can I get cash from Fairstone?

With access to a computer or mobile device equipped with a camera, individuals can borrow anywhere from $500 to $25,000 from Fairstone within 24 hours. The remarkable part is that this process can be completed from the comfort of one’s home. They can kick start the process by obtaining an online loan quote from any location using any device.