The mortgage is a vital part of the investment whether you are purchasing your first home, another apartment, or a commercial space. As the real estate market expands, it is critical to comprehend what is a mortgage, how does it work, and how to navigate the mortgage process.

We’ll go over the complexities of mortgages and how they can help you manage your investments and personal financial planning. This comprehensive guide will help you make informed decisions and take control, whether you’re a first-time homebuyer or a seasoned investor.

Understanding Mortgage Terms and Components and How Mortgages Work

A mortgage is a loan used to purchase real estate. The property you buy serves as collateral for the loan, which means that if you default on payments, the lender can seize the property to recoup their losses. The mortgage loan is typically repaid in monthly installments over a period of 15 to 30 years.

To fully comprehend mortgage, it is necessary to comprehend some key terms and components, such as:

- Principal: This is the sum borrowed from the lender.

- Interest: The fee charged by the lender for the loan, expressed as a percentage of the loan amount.

- Amortization: This refers to repaying a mortgage loan over time. Here, a portion of each payment goes toward interest, and the remainder goes toward the principal.

- Down payment: This is the down payment you make when you buy a home, depending on the lender and the type of mortgage you choose. It can range from 5% to 20% of the property’s value.

- Closing expenses: These are fees incurred when a mortgage loan is closed, such as appraisal fees, title fees, and other miscellaneous charges.

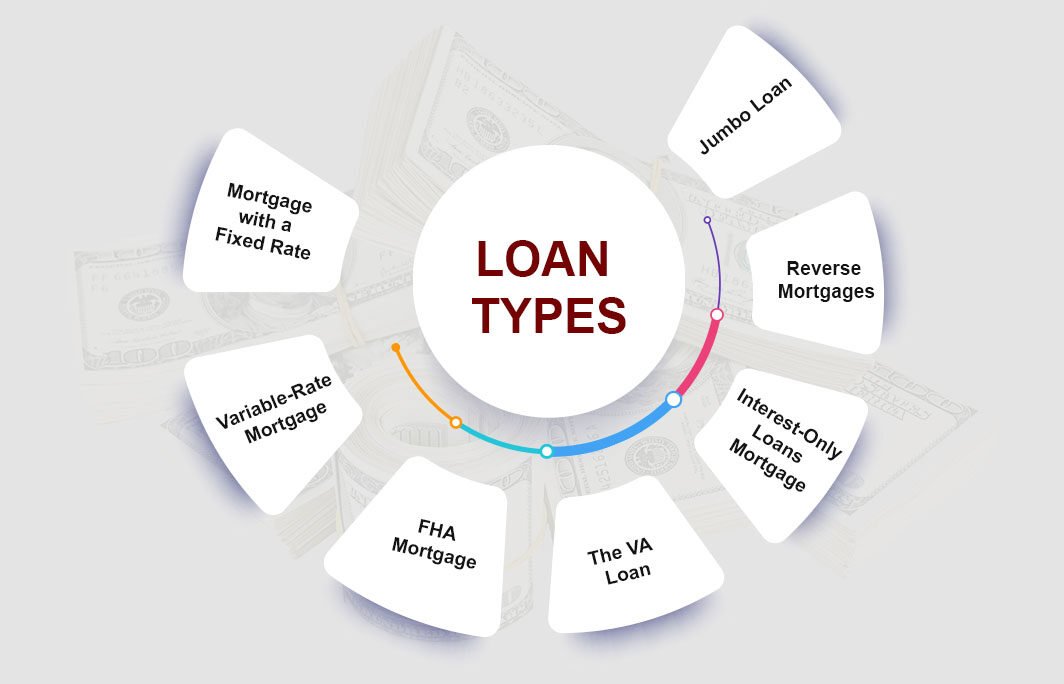

Different Types of Mortgage

Various types of mortgages are available, each with its advantages and disadvantages. The following are some of the most common types of mortgages:

-

Fixed-Rate Mortgage

Fixed-rate mortgages mean your monthly payments will remain the same for the life of the loan. This mortgage is ideal for those who want the security of predictable monthly payments.

-

Variable-Rate Mortgage

A variable-rate mortgage, sometimes known as a floating-rate mortgage, is a form of house loan in which the interest rate changes regularly. A variable-rate mortgage, as opposed to a fixed-rate mortgage, varies its interest payments based on a benchmark such as the Prime Rate + 2 points.

-

FHA Mortgage

The Federal Housing Administration insures this type of mortgage. It is intended to assist low and moderate-income borrowers in obtaining financing, and it usually requires a lower down payment than other types of mortgages.

-

The VA Loan

The Department of Veterans Affairs guarantees this type of mortgage. It is intended to assist qualified veterans and active-duty military personnel in purchasing a home.

-

Interest-Only Loans Mortgage

A Loan with Only Interest A mortgage is a sort of house loan in which the borrower only pays the interest for a set length of time, usually 5 to 10 years. During this time, the borrower makes no payments toward the principal or the amount borrowed.

-

Reverse Mortgages

A Reverse Mortgage is a form of loan that allows homeowners aged 62 and above to turn a portion of the equity in their house into cash. A reverse mortgage, as opposed to a standard mortgage, which requires the borrower to make monthly payments to the lender, pays the homeowner

-

Jumbo Loan

This mortgage exceeds Fannie Mae and Freddie Mac’s conforming loan limit. These have higher interest rates and more stringent credit requirements than other types of mortgages. Typically, the sum exceeds $100,000. They can be secured or unsecured and are frequently utilized for high costs such as property purchases, company financing, or debt consolidation. When considering a significant loan, it’s critical to analyze the interest rate, payback periods, and any fees or penalties. It’s also critical to compare offers from different lenders to locate the loan that best fits your demands and budget.

How to Apply and the Mortgage Process

The mortgage application process can be intimidating. However, with proper preparation and understanding of the process, it can be a smooth and stress-free experience. Here are some first steps you can take:

1. Examine your financial situation

Before applying for a mortgage, you should evaluate your financial situation and determine how much you can afford to borrow. This includes an examination of your credit score, earnings, and debts.

2. Look for a lender

To find the best mortgage for your needs. You should shop around and compare lenders. Look for a lender with the best mortgage rates and fees. An ideal lender will work with you to meet your financial goals.

3. Gather the documents

When applying for a mortgage. You will be required to provide financial and personal information such as tax returns, pay stubs, and bank statements. Before beginning the mortgage application process, ensure you have all the necessary documents.

4. Pre-approval

Once you’ve gathered the required information, you can apply for pre-approval. Which will give you an idea of how much you can afford to borrow. Pre-approval is essential in the mortgage process because it allows you to set a budget for your home search.

5. Property hunt

With a pre-approval letter, you can begin looking for your dream home or commercial space. When you find the property you want to buy, your lender will order an appraisal to determine its value.

6. Closing

You will need to close the loan once the appraisal is completed. This usually entails signing a loan agreement and paying any outstanding closing costs. You will begin making monthly mortgage payments after the loan is closed.

Mortgage Comparison

When looking for a mortgage, it is critical to compare various options and find the one that best meets your needs. Consider the following when comparing mortgages:

Rate of interest: You must compare mortgage rates as this is one of the most important aspects to consider in mortgages. It determines your monthly payments. Over the life of the loan, a lower interest rate can save you thousands of dollars.

Down payment: Depending on your mortgage type, you may be required to put down 5% to 20% of the property’s value.

Loan duration: Your monthly payments will also be affected by the loan’s term. A shorter loan term has higher monthly payments. But you will pay off the loan faster and save money on interest in the long run.

Closing expenses: When comparing mortgages. Keep in mind that closing costs can quickly add up and significantly impact your overall costs.

Conclusion

Taking a mortgage may seem like a complicated and intimidating process. However, with proper planning and understanding, you can secure the financing you need for your future home or commercial space. Compare mortgage options, whether you are a first-time homebuyer or a seasoned investor. Selecting the mortgage that best meets your financial needs is critical. You can make your dreams of homeownership or investment a reality by investing smartly.