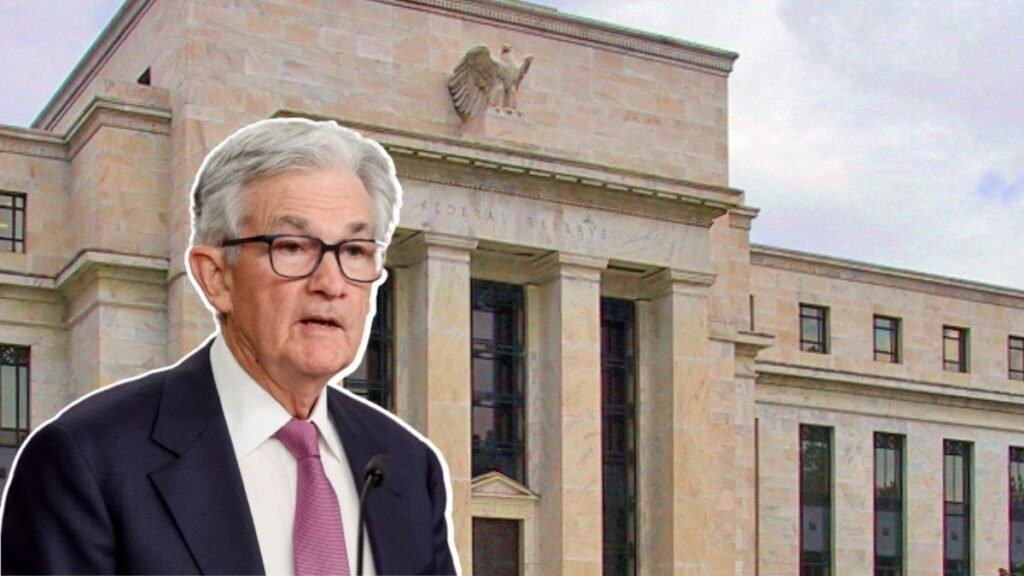

Eight months after increasing interest rates to their highest level in two decades, Federal Reserve Chair Jerome Powell and his colleagues are coming near to a decision as the battle against inflation is slowing down.

Last week, Powell gave congressional testimony, saying that the Federal Reserve needs a bit more proof that inflation is moving towards its 2% goal before introducing Fed rate cuts. He said that the economy is almost there.

Fed Rate Cuts 2024

Investors expect the Fed to keep interest rates steady for a fifth consecutive meeting when it meets on March 19 and 20. The Federal Open Market Committee is set to release its quarterly rate forecasts, and many will be watching closely, considering the new employment and inflation data.

If the Fed officials plan for three quarter-point rate cuts in 2024, it could lead to a potential introduction of Fed rate cuts in June, as forecasted by the investors.

According to Vincent Reinhart, Chief Economist at Dreyfus and Mellon, the Fed’s March message will likely be that the economy is on track and that they are getting closer to the right level of confidence regarding inflation.

Policymakers have all decided to keep interest rates stable without any change between 5.25% and 5.5% in January. Moreover, Powell and the other Fed officials mentioned that introducing Fed rate cuts in March was not probable.

One of the reasons for them to take their time is because the economy is still doing well, with strong growth and the job market adding a high number of jobs, including 275,000 more than expected in February.

The report also showed signs of slowing down, with previous months’ gains decreasing, slower wage growth, and the unemployment rate climbing to 3.9%, the highest it has been in two years.

What Do Economists Say?

Derek Tang, Economist with LH Meyer/Monetary Policy Analytics, said that recent data has decreased the possibility of postponing or reducing Fed rate cuts. He added that Powell’s speech, in which he mentioned that the Federal Reserve is not far from its 2% inflation target, shows that the Fed rate cuts will possibly remain unchanged.

Before the Fed starts its next meeting, some data are set to be released that might affect its decision. For example, the consumer price index is expected to show inflation at 3.1% compared to last year, according to economists surveyed by Bloomberg News.

The sudden increase in January affected the central bankers, and similarly, a sudden change in the February data could also impact the Fed rate cuts in 2024.

Fed officials are looking at different inflation indexes, like personal consumption expenditures, or the Fed’s preferred inflation data, which stood at a 2.4% rate in January and 2.8% excluding food and energy. However, some Fed officials are worried about small improvements in certain areas, such as goods.

The Fed’s “dot plot,” which includes forecasts from individual policymakers for interest rates, had a range of predictions in December and some policymakers changing their forecasts could shift the median prediction.

On Wednesday, Minneapolis Fed President Neel Kashkari said that he might consider lowering his prediction for Fed rate cuts to one less this year. He added that this decision will depend on the inflation data that will be observed in the coming days.

Powell has successfully maintained control of the committee, with no members of the Federal Reserve’s policymaking committee, the Federal Open Market Committee (FOMC), disagreeing with the decisions on monetary policy.

However, as the central bank shifts towards rate cuts, he might face challenges in keeping everyone together.

Diane Swonk, Chief Economist at KPMG LLP, said that some members are showing signs of disagreement on how to proceed with the Fed rate cuts. He added that the agreement on the decisions going forward might not be as strong as people were thinking, considering the imminent rate cut.

At the upcoming meeting, the Fed will also start its talks about reducing its $7.5 trillion balance sheet, also known as quantitative tightening. It has been reported that Powell might talk about the discussion progress during his press conference but there is no expected decision on slowing down asset runoff.

Read Also:

Bitcoin Price Goes Down After Reaching $69000 Milestone