A recent court challenge by 26 red states failed to overturn a workplace retirement plan, ESG rule under the Biden administration.

According to retirement experts, the primary win for the White House isn’t preserving the rule’s legal substance but instead influencing the discourse on ESG rule for investment funds in 401(k) plans.

ESG investing, synonymous with sustainable or impact investing, directs funds based on environmental, social, and governance criteria. For instance, climate-oriented mutual funds may prioritize green energy tech investments or exclude fossil fuel firms.

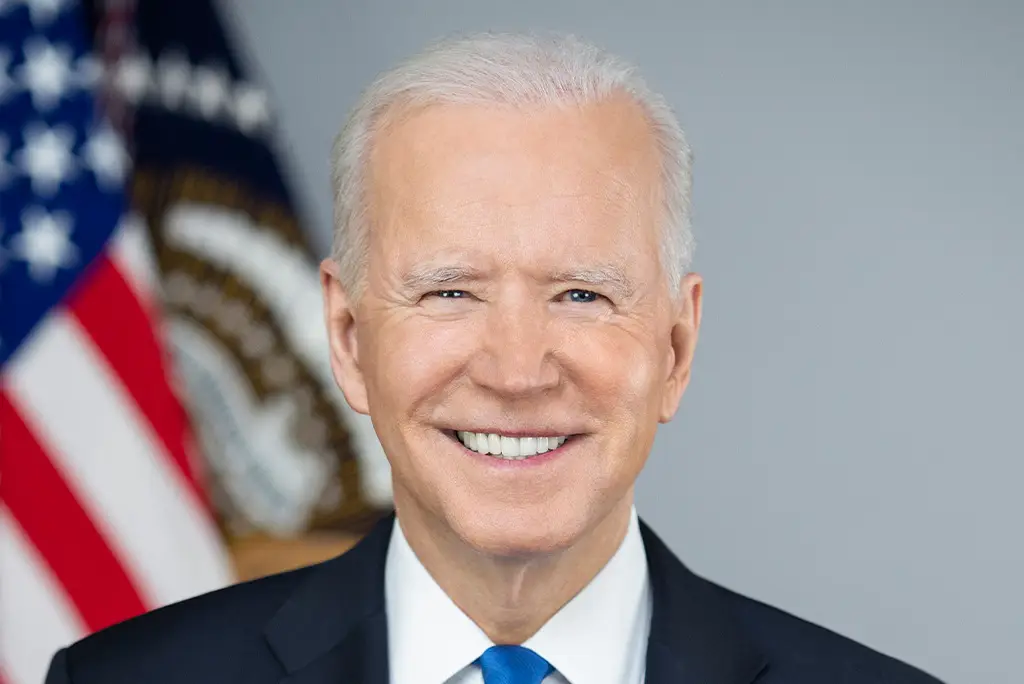

As of January 30, the Biden administration’s rule was part of White House endeavors to combat climate change. President Biden additionally enacted the Inflation Reduction Act, the largest climate legislation in US history.

Biden’s ESG rule superseded a regulation put forth by the Trump administration, which was anticipated to deter ESG adoption in 401(k) plans, a field with limited previous uptake.

ESG adoption remains low in 401(k) plans despite legal challenges

In 2021, only 4.2% of 401(k) plans provided ESG funds to employees, as the Plan Sponsor Council of America, a trade association reported.

According to the PSCA, these ESG funds collectively held approximately one-hundredth of 1% of total 401(k) assets.

Republican state attorneys general filed a lawsuit against the US Department of Labor, alleging violations of the Employee Retirement Income Security Act of 1974 and the Administrative Procedure Act regarding the rule’s promulgation.

A federal judge in the Northern District of Texas, appointed by Trump, rejected that contention. An appeal remains a possibility, and currently, the verdict upholds the Biden administration’s optimistic stance on ESG investments, as per experts.

Andrew Oringer, a partner at The Wagner Law Group and an expert in retirement law, stated that in a realm where perception holds substantial weight, the change in tone is highly significant.

Oringer suggested that if you’re a fiduciary considering ESG rule factors and believe the Department of Labor supports your stance, you might be more inclined to incorporate them.

Conversely, if you’re a fiduciary interested in ESG but perceive the Department of Labor as adversarial, you might be less inclined to embrace it.

Iwry: Biden and Trump ESG rules share a fundamental similarity

Mark Iwry, a former deputy assistant secretary in the US Department of the Treasury during the Obama administration, asserted that, from a legal perspective, the Biden and Trump rules share a fundamental similarity.

Iwry, currently a non-resident senior fellow at the Brookings Institution, emphasized that the rules implemented by Biden and Trump exhibit substantial likeness at their core.

To put it differently, returning to the Trump-era regulation wouldn’t have carried significant legal consequences.

Judge affirms continuity in ESG rules and ERISA’s core principles

Texas judge Matthew Kacsmaryk concurred, stating that the 2022 Rule retained much of the 2020 Rule’s substance and prior rulemakings.

In his opinion dated September 21, Judge Kacsmaryk referred to the ESG rule of both the Biden and Trump administrations.

ERISA, a federal retirement law, prohibits employers from selecting investments based on ideology and mandates a financial analysis.

Iwry noted that employers have the leeway to incorporate ESG rules into their investment decisions if they reasonably believe these factors materially affect financial risk and returns.

Experts emphasize that employers can favor non-economic considerations, like ESG and employee preferences, when a tie occurs, as in the case of a climate fund versus traditional funds.

Experts noted that these perspectives align with the Labor Department’s long-standing stance and remain consistent with both Biden and Trump-era rules.

The new rule aims to change the tone around retirement ESG plans

Andrew Oringer remarked that there are limitations to how much deviation can occur from ERISA’s mandates. Experts pointed out that despite subtle distinctions, the primary reason for introducing a new rule primarily revolves around setting a different tone.

Iwry conveyed that the Biden administration worried the narrative surrounding the Trump rule may have discouraged plans from contemplating ESG factors in investment assessments.

The new rule proclaims that there is no longer a chilling effect on plans’ inclination to weigh ESG considerations.

Retail investors have increasingly favored ESG funds, with US ESG fund assets reaching $286 billion in 2022, nearly tripling the 2018 figure, as reported by Morningstar.

ESG Funds Face Hurdles in 401(k) Plans

Experts noted that obstacles persist in adopting ESG funds in 401(k) plans.

One hindrance is the surge in class-action lawsuits by 401(k) investors against employers regarding investment choices in recent years.

According to experts, employers may feel apprehensive about introducing ESG funds into this landscape due to ongoing litigation.

The ESG rule from the Trump era caused unease in the community, and according to Oringer, that sense of unease lingers.

Oringer suggested that the potential for future shifts in tone from the Labor Department in both Democratic and Republican administrations might make them hesitant about pursuing ESG.

“We may never witness a stabilization of that pendulum,” he remarked, referring to the ongoing uncertainty.

Read More: Surging 401(k) Loans are Reflecting Inflation Stress in America

Claiming Retirement Early? These May Help Get Bigger Social Security Checks