The stock market is reaching new record highs, with the S&P 500 (^GSPC) and Nasdaq (^IXIC) closing the week at all-time highs. According to the research done by Deutsche Bank, the S&P 500 has seen gains in 16 of the last 18 weeks, something which has yet to be seen since 1971.

In the coming week, the stock market will face challenges with Federal Reserve Chair Jerome Powell’s testimony on Capitol Hill and the release of the Feb jobs report. There will also be updates on the activity in the services sector and job openings.

With most of the S&P 500 coming to a close with earnings, Target (TGT), Costco (COST), and Kroger (KR) are three major consumer brands that will be reporting results next week.

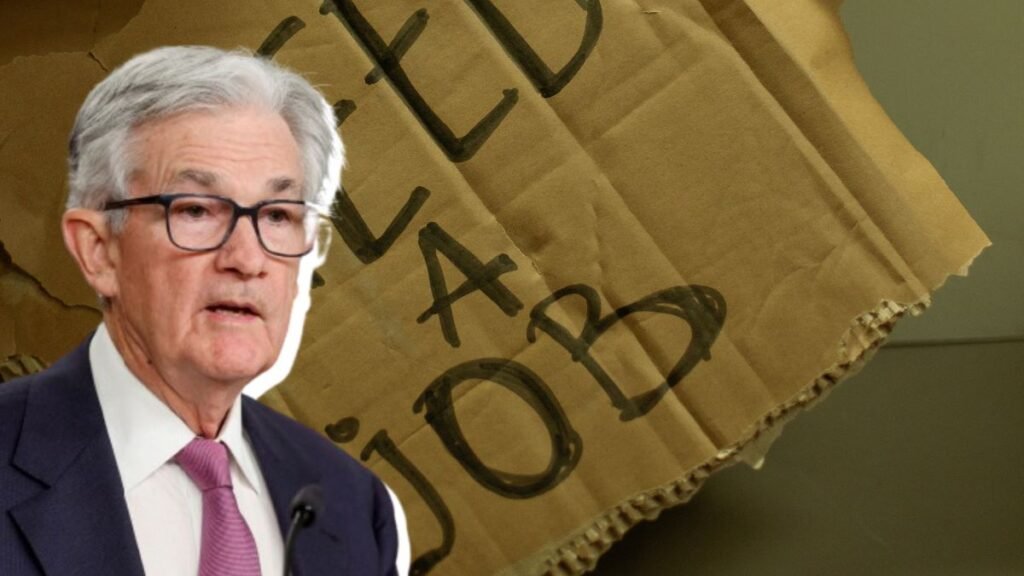

Fed’s Chair Testimony

Federal Reserve Chair Jerome Powell will give his semi-annual monetary policy testimony to Congress starting Wednesday. Investors will pay close attention to his updates on the US economy, inflation, and when the Fed might start cutting interest rates.

The market data from Bloomberg has suggested that investors might expect the Fed to lower interest rates three times this year, starting in June, as the rate of inflation is going down slowly. This prediction is similar to what Chair Powell had recently said and is along the same lines as the projections made by the Federal Reserve. The Federal Open Market Committee will talk about its latest policy decision and economic projections on March 20.

During the policy testimony, there is a high chance that Powell will get attacked with questions from lawmakers about the Fed’s strict policy and how the Federal Reserve plans to relax it, which is a touchy subject, especially during a presidential election year. During the Fed’s last meeting in January, the Fed officials talked to policymakers about the stability of the US financial system and called the system’s financial risks significant.

Feb Jobs Report and the Labor Market

Since the inflation has not been as high lately, many on Wall Street think the Fed will wait before lowering interest rates. Economists say it is important for the economy to avoid a recession so that the job market stays strong.

The upcoming week will feature the release of new data containing information on wages and job openings. The main event for this week will be the release of the Feb Jobs Report, which is set to be published on Friday morning at 8:30 am.

The upcoming Feb Jobs Report is predicted to show that the US economy gained 190,000 nonfarm payroll jobs last month, with the unemployment rate at 3.7%, as per Bloomberg data. In January, the economy had surprised Wall Street with 353,000 new jobs while maintaining the 3.7% unemployment rate for the third consecutive month.

The U.S. Bureau of Labor Statistics (BLS) releases the Employment Situation Summary, also called the Feds jobs report, at 8:30 a.m. ET on the first Friday of each month. This report uses surveys from households and employers to estimate the number of people employed, their average weekly hours worked, average hourly earnings, and various unemployment rates.

The Feds jobs report is an important economic release that arrives early with data from the previous month and is one of the highly anticipated and closely examined data. The investment firms make estimates on nonfarm payroll changes, unemployment rates, hours worked, and hourly earnings before the report and can significantly impact financial markets and help the Federal Reserve to understand the economy before setting monetary policy.

Update on the Market

Nearly all of the S&P 500 companies have reported their earnings for the fourth quarter. According to new FactSet data, the index is expected to show a 4% increase in earnings compared to the same period last year. This is the second quarter in a row with earnings growth for the benchmark index.

John Butters, a senior earnings analyst at FactSet, said that the analysts usually lower their earnings estimates in the first two months of a quarter. Over the past 20 years, earnings estimates have been reduced by an average of 2.9%. However, the estimates have only decreased by 2.2% for this current quarter.

Many Wall Street experts predicted a bumpy start to 2024, followed by a strong finish later in the year. They believed investors would be worried about the Federal Reserve’s interest rate cuts and concerns about the elections.

That changed, though. The earning reports which were reported by the Big Tech firms have made the reported earnings of the S&P 500 and Nasdaq Composite have their strongest February since 2015. This outlook for earnings led many Wall Street strategists to increase their year-end targets for the S&P 500.

If history is any indication, stocks will probably keep increasing. The research conducted by the Carson Group’s Ryan Detrick found that in 28 out of 31 years since 1950, when the S&P 500 started positively in January and February, it ended the next 12 months positively. It is usually seen that when the first two months have been positive, the S&P 500 has increased almost 19.9% for the year.

Detrick said that this is not an accurate prediction for an almost 20% return this year, but if the S&P 500 did increase by the average amount, it would finish 2024 at 5719.

Also Read:

Fed’s Mester Still Anticipates 3 Rate Cuts in 2024 After PCE Data Release

Fed Officials Prioritize Economic Data in Determining Pace of Interest Rate Cuts

No Loan Policies Being Adopted by More Universities to Attract Students