This week has seen a change in tone of Federal policymakers, yet they talk little about rate cuts. Numerous policymakers, including six who are set to vote on policy next year, have expressed comfort in maintaining interest rates at the upcoming December meeting. Their confidence stems from a downward trend in inflation and data indicating a slowdown in the economy.

While this brings hope as well as discussions, the question that arises is, how close are we to the central bank’s rate cut?

Despite Federal Reserve officials showing minimal interest in talking about rate cuts, markets swiftly seized upon remarks from Governor Christopher Waller.

As a closely monitored inflation hawk on Wall Street, Waller acknowledged that the Fed would contemplate reducing rates if inflation continues to decline. It aligns with conventional policy guidelines followed by central bankers.

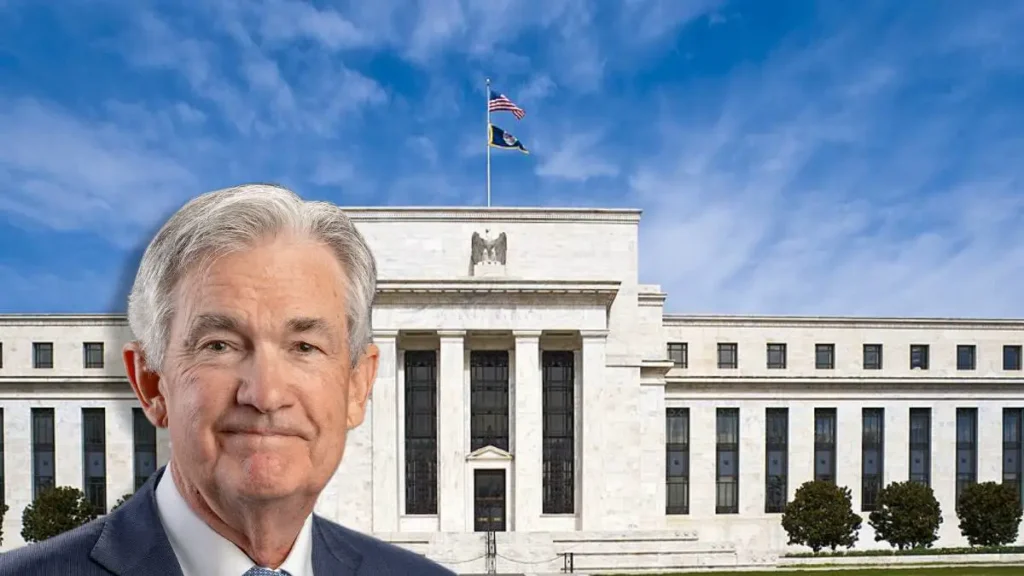

Powell’s diverging views on rate cuts

As Fed Chair Jerome Powell prepares to address Spelman College in Atlanta this Friday, it’s highly probable that he will emphasise the premature nature of declaring victory rather than delving into discussions about rate cuts.

The prevailing worry about a potential resurgence of inflation is expected to lead the Federal Open Market Committee to project significantly higher interest rates in 2024 compared to the four quarter-point cuts anticipated by the markets.

Powell will tread cautiously, avoiding premature celebration, but the narrative is poised to transition from “higher for longer” to “higher for long enough,” notes Diane Swonk, chief economist at KPMG.

The accelerated decline in inflation, surpassing their earlier projections, suggests a likelihood of incorporating more rate cuts than contemplated in September.

The likelihood of a quarter-point cut at the FOMC’s March meeting has reached a coin toss, and markets have fully factored in a cut by May.

Anticipating over a full point of cuts by the year’s end, there’s a notable contrast with Fed officials’ projections.

In September, their median forecast pointed to rates between 5-5.25% by the end of 2024, just a quarter-point below the present level.

As we approach the FOMC’s March meeting, the chances of a quarter-point cut have become as uncertain as a coin toss, while markets completely anticipate a cut in May.

Forecasts indicate an expectation of over a full percentage point in cuts by the close of the upcoming year.

Fed’s Forecast Shows Moderation While Wall Street’s Predictions are Bold

In contrast, Federal Reserve officials, as per their median forecast from September, foresaw rates ranging between 5-5.25% by the end of 2024, a mere quarter-point reduction from the present level.

Certain Wall Street predictions are notably assertive. Deutsche Bank, foreseeing a mild recession in the coming year, has restated its belief that the Fed could initiate cuts as early as June. They are aiming for a total reduction of 175 basis points by year-end.

On an even swiffer timeline, billionaire investor Bill Ackman anticipates the central bank making rate cuts as early as the first quarter of 2024.

Yelena Shulyatyeva, senior US economist at BNP Paribas noted that the anticipation for Chair Powell to express views on rate cuts has notably increased following recent comments from Waller.

While he may not definitively endorse a new dovish stance, there is a growing expectation for Powell to address the evolving discourse on rate adjustments.

The primary goal for the Fed isn’t necessarily achieving a soft landing, but rather, it’s about bringing inflation back to the 2% target, as emphasised by Yelena.

Inflation Slows Down, Bringing Hope for Rapid Rate Cuts

Recent inflation updates have shown positive signs, with the core personal consumption expenditures price index increasing by 0.2% in October, excluding the volatile food and energy components.

Additionally, headline inflation has progressed at an annual pace of 3%, marking the slowest rate since 2021.

Despite positive indicators, policymakers harbor concerns that progress on inflation might halt or reverse.

Thomas Barkin of the Richmond Fed and Fed Governor Michelle Bowman have explicitly voiced this apprehension. They are suggesting the potential for additional hikes if inflation persists stubbornly.

Kathy Jones, Chief Fixed Income Strategist at Charles Schwab, doesn’t anticipate Powell signalling rate cuts in the first quarter.

She suggests he will likely avoid specifying any timeframe but might express contentment with the current situation, highlighting the decline in inflation and the sustained low levels of unemployment.

Read More: Federal Reserve Beige Book Warns of Slowing Economic Growth

Fed Officials Change Stance But Remain Wary of Rate Cut Bets