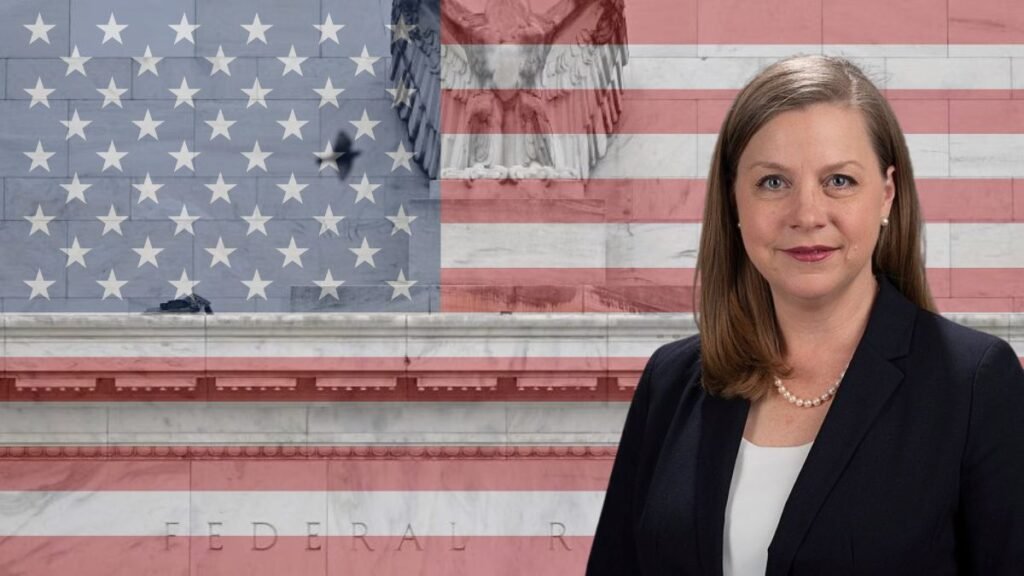

Fed Governor Michelle Bowman recently said that she believes inflation will keep going down if interest rates stay where they are. She also mentioned it’s not yet time to introduce interest rate cuts.

Fed Governor Michelle Bowman Reflects On Interest Rate Cuts

Fed Governor Michelle Bowman has mentioned that she will keep a close eye on new information to decide what to do next with policies. She also pointed out some things that could make inflation worse, like conflicts around the world, financial conditions getting loosened, and the job market staying tight.

But what do loose financial conditions and a tight job market mean? Loosening financial conditions means that it becomes easier for businesses and individuals to borrow money due to lower interest rates, increased availability of credit, or other resulting in increased spending, investment, and potentially higher inflation.

Similarly, when the labor market is “tight,” it means that there are few people who are unemployed and looking for work, resulting in higher wages and benefits to attract and retain employees, contributing to high pressure on wages and inflation.

In a speech on Friday, Bowman, addressing the crowd at Florida Bankers Association, said that If the data keeps showing that the inflation is slowly getting closer to the Fed’s 2% target, it will make sense to reduce the policy rate to avoid making monetary policy too tight, however, according to her the economy is not there yet.

In her talk about monetary policy, which sounded a lot like what she said earlier this month, Bowman cautioned that if we cut interest rates too early, we might have to raise them again later on.

She said that the current monetary policy is set to bring inflation down to 2% eventually, but if new data shows that progress on inflation has stopped or gone backward, she is open to raising the federal funds rate at the next Federal Reserve meeting.

Regarding regulations, Bowman once again suggested making big changes to a July proposal which will require the banks to have more capital.

Fed Governor Michelle Bowman said that she was also worried about the idea of reducing the limits on the fees that banks and payment companies can charge merchants for debit card transactions.

She added that she was concerned about how officials view bank mergers and suggested that the regulators should work on making the Fed’s discount window work better.

Will there be Interest Rate Cuts?

The central bank has said it is not a question of if but when. However, the interest rate cuts will not happen until at least springtime.

To fight against the increasing inflation, the Fed has increased the federal funds rate 11 times from March 2022 to July 2023. In December 2023, they had predicted three quarter-point cuts by the end of 2024 to bring the benchmark rate down to 4.6%.

Prices have started to reduce; however, the Federal Reserve wants to wait for more good news before making any changes.

During the first meeting of 2024, held on 30 and 31 January, the Federal Open Market Committee (FOMC) kept the interest rates the same at a target range of 5.25 to 5.5%, the highest it has been in over 20 years.

The FOMC will have seven chances left this year to lower interest rates, beginning with its upcoming meeting on March 19 and 20.

Read Also:

Fed Rate Cuts Plans Not Thwarted by Strong US Economy

Bitcoin Price Today Reaches $57000, A First After Two Years

Goldman Sachs Strategists See Potential for the Stock Market Rally to Expand