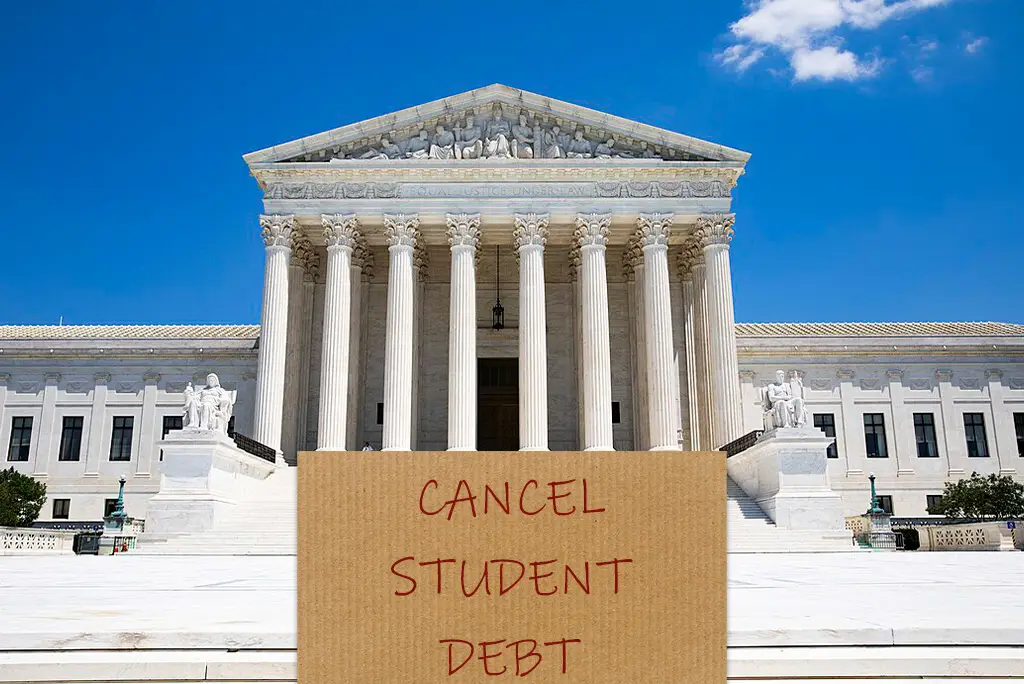

The Supreme Court’s decision on federal student loan forgiveness puts borrowers at risk. The Consumer Financial Protection Bureau reported that 20% of borrowers face risk factors.

The Supreme Court struck down President Biden’s student loan forgiveness proposal. The Supreme Court’s ruling was a disappointment for students.

Repayment for student loans is set to resume in October, increasing financial strain for many. The risk factors suggest that borrowers may struggle to cover their bills post-pandemic.

The federal watchdog agency’s report highlights the challenges faced by student loan borrowers. Financial hardship forbearance provided temporary relief, but interest continued to accumulate.

The survival of Biden’s plan would have completely wiped out many student loan balances. Students with a Pell Grant recipient have been eligible for the potential relief.

The Supreme Court decision will result in a record number of borrowers entering repayment simultaneously. According to a CFPB spokesperson, this will affect more borrowers than any other product type.

Risk factors in student loan repayment

Late payments on student loans before the Covid-19 outbreak. Financial aid was provided for student loan payments before the pandemic. Dealing with multiple companies responsible for servicing student loans. Late payments on other types of loans since the pandemic began. New non-medical debts have been sent to collections during the pandemic.

Moreover, Jack Wallace from Yrefy emphasized the need for borrowers to plan and manage their payments. Consequently, borrowers must make proper decisions to meet their payment obligations. Additionally, the upcoming payments will significantly impact their monthly cash flows.

To handle these payments effectively, borrowers must make appropriate plans and arrangements. Notably, Jack Wallace highlighted the importance of making informed decisions about repayment.

Furthermore, students have set overcoming the financial challenge of student loans as a primary goal. They anticipate achieving debt freedom in the next few years.

Rising Higher Education Cost is More Intimidating

It is worth noting that student loan debt in the U.S. has reached a staggering $1.8 trillion, as reported by the Federal Reserve. Moreover, higher education costs continue to rise, with tuition and fees more than doubling in 20 years. For instance, in-state public college costs reached $10,940, while private institutions charged up to $39,400.

Finding their servicer on the federal student aid website is essential for graduates who have never made a repayment. Accessing timely information about monthly payments and alternatives is crucial.

Wallace advises setting up an account on the FSA website to stay well-informed about their payment obligations.

Ensuring that no important loan details are missed is vital for students. The FSA website provides valuable resources to help manage student loan repayments.

Being proactive and staying informed can help borrowers navigate their student loan journey effectively.

Wallace Suggested Some Considerations to Students

Consider income repayment plans to keep borrowers outside of delinquencies and defaults. Contact your servicer immediately to ensure they have your correct information.

Take advantage of the opportunity for a fresh start if you previously had delinquencies or defaults. Wallace sees this as a positive chance to improve credit and financial standing.

Explore public service forgiveness programs to alleviate monthly payment burdens. The public service loan forgiveness program extends beyond government employees. It applies to qualifying payments in public service or interest jobs.

Teachers, firefighters, and other first responders can benefit from this program.

Evaluate the potential benefits of loan forgiveness after 10 years of qualifying payments. Income-driven repayment programs can lower monthly payments to as low as zero dollars. These programs help borrowers avoid delinquencies and defaults.

Wallace suggests taking advantage of these options for relief and improved financial well-being.