The major US stock indexes fell from their record highs just before the Fed March Meeting, which is supposed to occur on March 19 and 20.

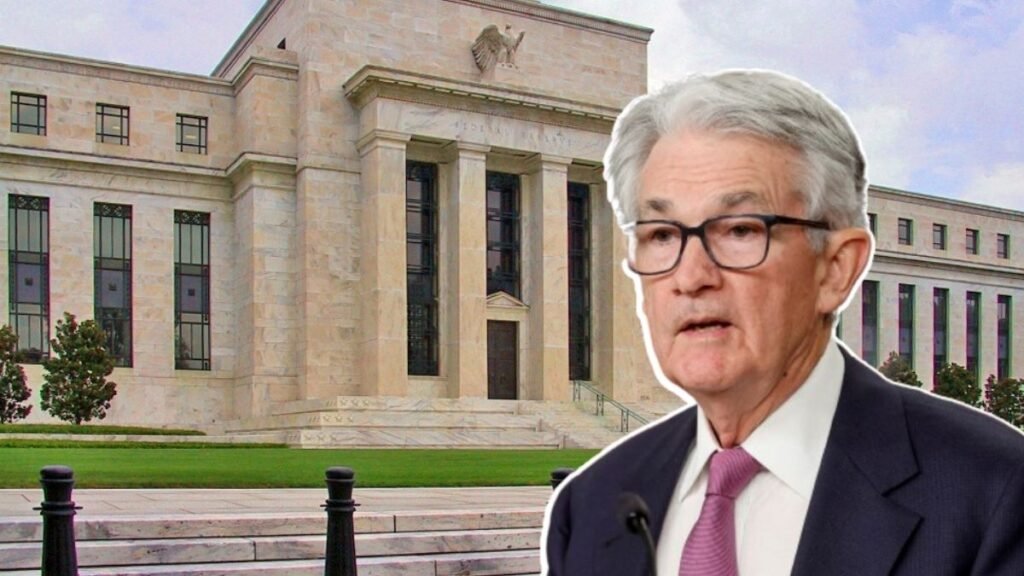

Fed March Meeting

The US central bank will also reveal its latest monetary policy decision and update the economic projections at 2 p.m. on Wednesday. However, with the Fed March Meeting happening this week, investors are eager to know the Fed’s decision on the possibility of introducing rate cuts this year.

Recent data has shown that inflation is not going down as fast as hoped, which has reduced the market forecasts for Fed rate cuts this year from six to three. However, the main question now is whether a few months of inflation data will be enough to get a final answer from the Federal Reserve during the Fed’s March meeting.

Investors are not expecting any changes in the Fed’s main interest rates, which have remained between 5.25% and 5.50% since last July.

This means there is a high probability that the investors will be keeping a lookout for the Fed’s latest Summary of Economic Projections (SEP) and Fed Chair Jerome Powell’s press conference, which starts 30 minutes after the SEP and policy statement are released.

Matthew Luzzetti, Deutsche Bank’s chief US economist thinks that the recent inflation numbers will make the Fed sound “hawkish” in their messaging that is reported to take place on Wednesday.

Luzzetti added that the press conference of Chair Powell will likely highlight the fact that while the officials are still confident in the direction of inflation, seeing softer inflation numbers in the upcoming months is quite important before they consider any decisions regarding easing of monetary policy and ultimately introducing rate cuts.

Feds December meeting had pushed people to talk about a possibility of a rate cut in January, and it seemed likely for March. However, new data from the CME Group has suggested that the rate cuts will probably not be seen until July, with a probability of more than 50%.

What to Know this Week

Other than the Feds March meeting, this week is going to witness the earnings reports of companies like Nike (NKE), Lululemon (LULU), FedEx (FDX), and Micron (MU), scheduled to release their earnings reports on Thursday.

Apart from the Fed March Meeting and the release reports, corporate results are expected to be relatively weak. Regarding IPOs, Reddit is set to debut on the public market on Thursday under the ticker ‘RDDT,’ as investors are curious if more companies will be able to go public successfully in 2024 compared to the slowdown in new IPOs last year.

On the other hand, it has been reported that Nvidia (NVDA) is having its GTC conference on Monday. As there has been a large development in the Artificial Intelligence sector, the company’s chips have increased in demand, resulting in more people looking forward to the potential new releases from the company.

This boom resulted in an increase in the value of Nvidia’s stock by almost 260% last year. However, in the last two weeks, no significant change in the value of the stock has been seen. This primarily might be due to the holding pattern often seen by investors to see the results of the upcoming conference and the decisions taken up in the Fed March Meeting.

Read Also:

US Dollar Edges Up, Bitcoin Hits A New Record High

World Central Banks’ Stance Regarding Rate Cuts in 2024

Wall Street Forecasts Trying to Catch Up with the US Economy