The Apple Credit Card has been making waves in the United States since its launch in 2019. It offers a sleek titanium card design, deep integration with Apple Pay, and an attractive cashback program. However, Canadian consumers have been left wondering if and when this premium credit card would make its way north of the border.

Recent rumors suggest that Apple may soon introduce its credit card offering to the Canadian market. With its innovative features and Apple’s brand recognition, the Apple Credit Card could entice many Canadians to apply. But is it the right choice for you?

This article will explore the pros and cons of the Apple Credit Card in Canada, helping you decide whether it is suitable for your financial needs and spending habits.

Benefits of the Apple Credit Card in Canada

Apple Credit Card Cashback Rewards and Earning Rates

- One of the highlights of the Apple Credit Card is its appealing cashback rewards program. Cardholders can earn an impressive 3% cashback on all Apple purchases, including devices, accessories, and services like Apple Music and iCloud storage.

- The Apple Card also has some pretty sweet cashback rates for everyday purchases. You’ll earn 2% back on groceries to help with the weekly food budget. And for everything else you buy, whether clothes, gas, or nights out, you still earn a solid 1% cashback.

- The Apple Credit Card provides you with options for utilizing your cashback rewards. You can use the rewards as a statement credit to reduce your outstanding balance or receive the cashback directly deposited into your bank account or Apple Cash card. These make it an ideal cashback credit card.

Integration of Apple Credit Card with Apple Ecosystem

- The Apple Credit Card seamlessly integrates with the Apple ecosystem, providing a convenient and user-friendly experience. Cardholders can easily manage their accounts, track spending, and redeem rewards through the Apple Wallet app on their iPhone or iPad.

- With Apple Pay integration, making purchases is easy. Users can hold their Apple device near a contactless payment terminal to complete transactions securely.

- Apple has developed an intelligent system that monitors fraudulent activities to protect your money and personal information.

- If you’re a new Apple credit cardholder, you might get cool bonuses or special deals when you sign up, which makes applying even more tempting!

Apple Customer Service and Support

- Apple is known for its customer-centric approach, and the Apple Credit Card is likely to follow suit with dedicated customer service and support channels. This could include in-app, phone, or in-store support at Apple retail locations.

Compatibility of Apple Credit Card with Other Financial Tools

- Consider how the Apple Credit Card Canada integrates with other financial tools or budgeting apps you may use. Seamless integration with popular personal finance applications can make managing your spending and tracking your rewards easier.

Apple Credit Card’s Introductory APR Offers

- Many credit card issuers offer introductory 0% APR periods on purchases or balance transfers to attract new customers. If the Apple Credit Card provides such an offer, it could be a valuable incentive for those looking to finance larger purchases or consolidate existing debt.

Other Perks

- The Apple Credit Card may offer additional perks, such as extended warranties on eligible Apple purchases and purchase protection against theft or damage, further enhancing the value proposition for Apple enthusiasts.

Drawbacks of the Apple Credit Card in Canada

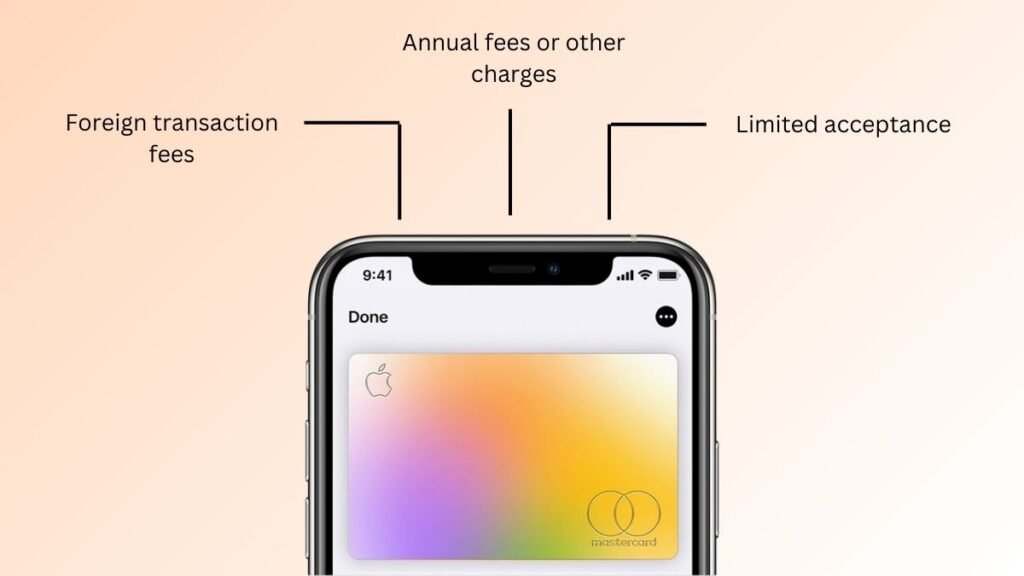

Limited Acceptance of Apple Credit Card

- While the Apple Credit Card can be used anywhere that accepts Mastercard, its acceptance may be limited in certain regions or with specific merchants, particularly those with exclusive partnerships with other payment networks.

Foreign Transaction Fees of Apple Credit Card

- When using the Apple Credit Card for international transactions or purchases made in a currency other than Canadian dollars, cardholders may be subject to foreign transaction fees, which can add up and diminish the overall value of the rewards earned.

Apple Credit Card Annual Fees or Other Charges

- Depending on the specific terms and conditions, the Apple Credit Card may come with an annual fee or other charges, which could offset some users’ benefits of the cashback rewards program.

Potential for Overspending Due to the Convenience of Apple Pay

- The seamless integration of the Apple Credit Card with Apple Pay and the Apple Wallet app can make it easier to make impulse purchases or overspend, especially for those who struggle with budgeting or financial discipline.

Final Thoughts and Recommendations

The Apple Credit Card in Canada offers a compelling combination of cashback rewards, seamless integration with the Apple ecosystem, and potentially valuable perks. However, it’s essential to consider the potential drawbacks, such as limited acceptance, foreign transaction fees, and the potential for overspending due to the convenience of Apple Pay.

For Apple enthusiasts who primarily make purchases within the Apple ecosystem and have a good grasp on their spending habits, the Apple Credit Card could be a worthwhile addition to their wallet. However, for those who frequently travel internationally or have a diverse range of spending categories, exploring other credit card options that better align with their needs may be beneficial.

Ultimately, the decision to apply for the Apple Credit Card in Canada should be based on carefully evaluating your financial situation, spending patterns, and overall goals. By weighing the pros and cons outlined in this article, you can make an informed choice that aligns with your preferences and financial well-being.

FAQs

Is Apple credit card sound?

The Apple Credit Card can be an excellent option for avid Apple users looking to maximize cashback earnings on purchases and seamlessly integrate with the ecosystem. Its 3% cashback rate on Apple products, advanced security features, and no annual or foreign transaction fees make it appealing to those deeply invested in the Apple world. However, limited acceptance outside Mastercard and the potential for overspending due to Apple Pay's convenience may make it less desirable for those with diverse spending habits or budgeting challenges.

What credit score do you need for an Apple Card?

You'll generally need a good to excellent credit score to qualify for the Apple Card, typically in the 670-850 range. Apple has yet to disclose a specific minimum credit score requirement, but reports suggest scores in the low 600s may be too intense for approval. Your credit utilization ratio, payment history, and overall creditworthiness will be evaluated during the application process.

How do you get Cashback on Apple credit cards?

Earning cashback with the Apple Credit Card in Canada is straightforward. Cardholders automatically receive 3% cashback on all purchases directly with Apple, including devices, accessories, apps, subscriptions, and more. For other purchases, you'll earn 2% cashback on categories like groceries and 1% on all other expenditures. The cashback is issued daily as Apple Cash in your Apple Wallet app and can be used for purchases, sent to friends and family, or transferred to your bank account.

Also Read: