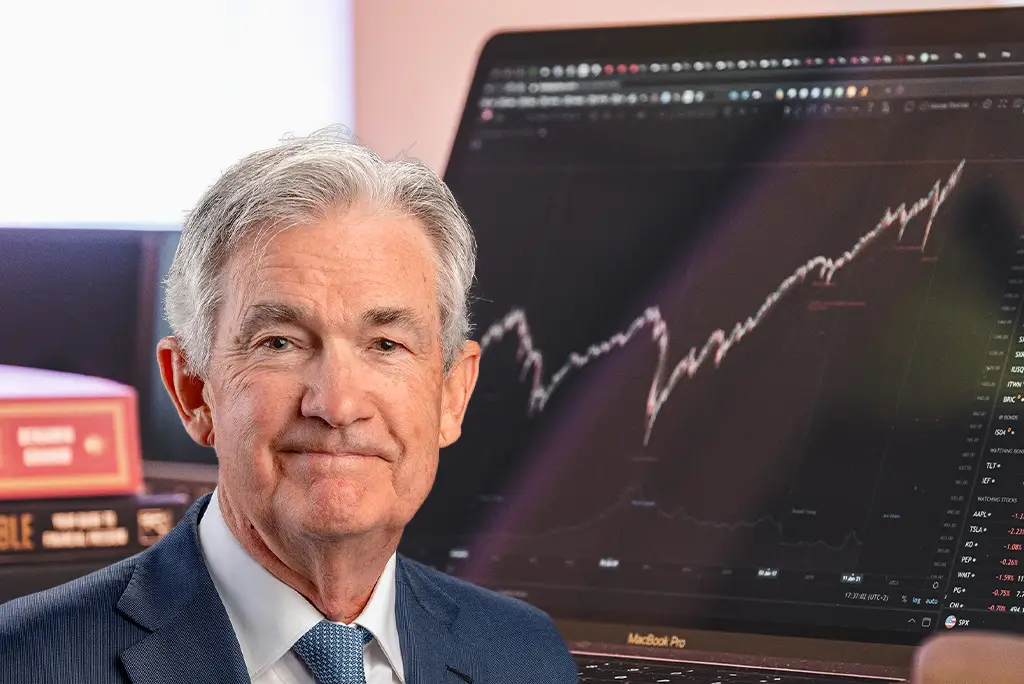

US stock futures saw an uptick, while Treasury bond prices declined following a weekend agreement to avert a US government shutdown. Market participants eagerly anticipate comments from Federal Reserve Chair Jerome Powell scheduled for later today.

In the early hours of Asia’s trading session, S&P 500 futures surged by up to 0.7%. The successful passage of a bipartisan agreement in US Congress on Saturday influenced the surge.

In a last-hour agreement on Saturday, Congress averted the government shutdown.

Congress approved a temporary spending bill that extends government operations for an additional 45 days. This accord secures government funding until November 17.

However, this means that lawmakers will need to return to negotiations, and the possibility of another government shutdown looms if a long-term funding solution is not reached by the end of this period.

Global markets react to US government shutdown aversion

Meanwhile, Asia’s primary stock index relinquished its earlier advances, while futures for European equities showed a slight dip.

Several Asian markets, including China, remained closed due to public holidays. This development underscores the intricate interplay between global financial markets and geopolitical events.

Financial markets had been preparing for a government shutdown, so there is a sense of relief with the recent development. Although it is temporary, Yung-Yu Ma, Chief Investment Officer at BMO Wealth Management, commented.

“The focus remains on interest rates and the Federal Reserve’s hawkish stance.” He added that all these will continue to be the key factors influencing the markets in the coming weeks.

In most parts of the world, a government shutdown is typically associated with turmoil, such as revolution, invasion, or natural disasters. Therefore, it has surprised many that leaders of one of the world’s most influential nations would intentionally create a crisis that disrupts public services and hampers economic growth.

Key financial developments and outlook

Federal Reserve Chair Jerome Powell is scheduled to participate in a roundtable discussion in Pennsylvania. Philadelphia Fed President Patrick Harker is also joining the meeting. This event is noteworthy as it provides insight into the central bank’s perspective.

The upcoming week will also bring attention to US manufacturing activity and job data. Also notably, the head of the New York Fed expressed on Friday that policymakers should maintain higher interest rates for an extended period. Thus adding to interest rate anticipation in the market.

Following the avoidance of a US government shutdown, Treasuries saw a decline in value. Also, the market’s attention shifted back to the trajectory of interest rates.

US 10-year yields increased by four basis points, reaching 4.61%. Whereas their five-year counterparts also saw a similar rise to 4.64%. Concurrently, the US dollar strengthened in comparison to all other Group-of-10 currencies.

US stock futures showed gains on the first trading day of October. That may offer a brief respite in a challenging period for global financial markets. The July-to-September quarter was challenging, marked as the worst for MSCI’s all-country equity index since September 2022.

Elevated interest rates, concerns about inflation, and slowing economic growth exacerbated by surging oil prices contributed to this challenging environment.

Higher rates, tighter fiscal policy, and rising bond yields will affect the economy. Vasu Menon, Managing Director at OCBC, expects a slowdown. He predicts a possible US recession in the first half of 2024.

Previous US government shutdown

The inaugural US government shutdown was in 1981, triggered by President Reagan’s funding bill veto. That lasted only a few days. Since then, there have been over ten shutdowns, ranging from half a day to over a month. The most recent shutdown, from December 21, 2018, to January 25, 2019, set the record as the longest in history.

During the last government shutdown, vital services such as social security and military operations remained operational. However, numerous federal workers went unpaid. The White House estimated that for each week the salary interruption persisted, the shutdown diminished GDP growth by 0.1 percentage points.

In contrast to the US, many European democracies with parliamentary systems rarely face a government shutdown. This is because the executive and legislature are typically under the control of the same party or coalition.

While a parliament could reject a budget proposed by the prime minister, it’s more likely to prompt a new election rather than a disruption in services like those seen in the US, such as national parks, tax refunds, and food assistance programs.